ACMA report suggests online video growth not harming live broadcast

Online video continues to grow with ABC’s iView service dominating its commercial competitors, but live broadcast TV remains the dominant medium, according to a report released by the Australian Communications and Media Authority (ACMA) today.

The latest Australian multi-screen report reveals in 2013 86 per cent of those online aged 16 years and over watched TV compared with 37 per cent watching time-shifted television and 31 per cent watching catch-up services. Online Australians spent an average of 14.7 hours per week consuming live television, compared with 7.8 hours for time-shifted television and three hours for catch-up services, according to the report.

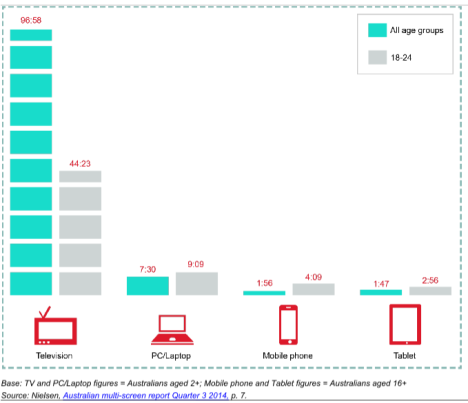

But, when the numbers are broken down for the 18-24 demographic the picture shifts dramatically, with time spent watching live TV more than halving from 97 hours to 44.23 hours per month, and the time spent watching video services on mobile devices doubling to 4.09 hours on phones and 2.56 hours on tablet.

The report reveals almost eight million Australians had watched some form of online video content in the six months to June 2014, a five per cent increase from May 2013, with just under half watching at least one catch-up program in the previous six months, 13 per cent accessing paid commercial online video services such as Fetch TV, and nine per cent viewing on-demand content on sites such as Quickflix and Apple TV.

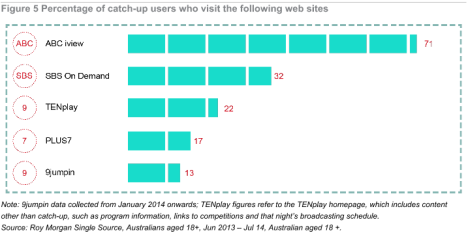

Of the five free to air networks offering catch-up and on demand services the most successful by far was the ABC’s iView which has also been in the market the longest with an average of 71 per cent of catch-up viewers using it per month, followed by SBS On Demand at 32 per cent. While TenPlay was the most successful of the commercial networks at 22 per cent, that includes time spent looking at micro-sites on the platform, while Plus7 was just ahead of Nine’s JumpIn with 17 per cent to 13 per cent.

Hugh Clapin, ACMA’s manager of research and analysis said the results speak to a number of changes underway in the Australian online video market, with new video streaming services like Stan, Presto and Netflix also being established this year.

“What we are seeing is a really exciting and interesting moment of change. There’s new entrants and players like Netflix are going to come in, we’ve got Australian players forming joint ventures across Free TV and subscription TV and other media,” he told Mumbrella.

“So from the industry development perspective there’s lots going on and what I think that means is there’s a lot more competition and a lot more choice for consumers.”

“I think one thing that’s clear in the report is the importance of catch up TV, and catch up TV has been in Australia for a while, but I think there’s been a bit of a fresh launch of it through HbbTV through Freeview, and that availability that’s been part of online content that I think has been growing.”

The report also revealed that online video content was most popular amongst younger Australians, with 61 per cent of the age groups 25-34 and 35-44 saying they used of online video services, in the 18-24 category 55 percent had used some form of online video service. At the other end only 31 per cent of those aged 65 and over had used online video services.

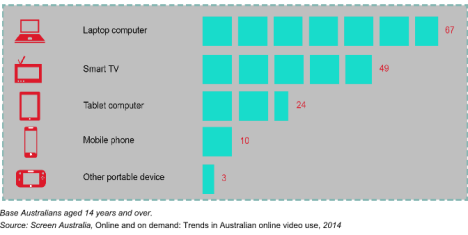

The preferred device for accessing OVC also varies according to the viewer’s age, with Australians aged 16–24 years far more likely than older consumers to view video content on a mobile phone or tablet. In 2013–14, 82 per cent of ABC4Kids iView content was viewed using a mobile device.

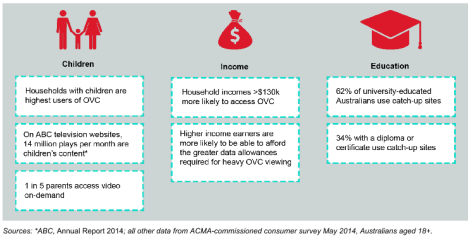

Further, the data showed that it was wealthier, better educated households with children that were the most likely to consume online video.

The ACMA research revealed that the presence of children in the household, a tertiary education and a high income level were the strongest predictors of online video use. Those who live with their children are more likely to access online video content (57 per cent) than those who reside in households without children (46 per cent).

This was further supported by the fact that 58 per cent of ABC iView’s 19 million plays per month during 2013-14 were of children’s content.

“We are certainly seeing some interesting demographic information about where online content is more popular,” said Clapin.

“We find that it’s households with children at home that are really driving and very strongly represented in the online video content figures, and if you look at iView they are repotting that significant amounts of their online downloads are children’s content.”

According to Clapin, the growth in online consumption was not having a significant impact on traditional broadcast TV viewing and played down the implications of the data for broadcast TV.

“Certainly the data shows that 96 per cent of Australians are still mostly watching broadcast TV, either free to air or subscription television. You compare that to online video which is much much smaller,” he said.

“So the comparison with traditional TV, we need to be really careful about that, traditional TV is there and even in the online space, traditional TV through catch up TV is very much the big player, or even dominant player.”

The report is based on ACMA’s annual commissioned consumer survey, conducted in May 2014 by Newspoll on behalf of the ACMA and with additional data from Roy Morgan research.

Robert Burton-Bradley