Domain drives growth for Fairfax as company continues on path from print to digital

Fairfax Media managed to boost its revenues with digital real estate division Domain swelling the company’s half yearly results as the traditional print side of the business continues to struggle.

Fairfax Media managed to boost its revenues with digital real estate division Domain swelling the company’s half yearly results as the traditional print side of the business continues to struggle.

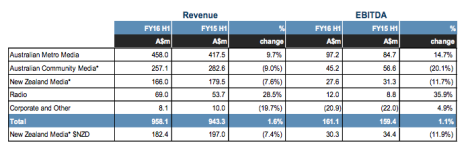

Revenue for the second half of last year grew by 1.6%, with group EBITDA for the publishing company up 15.5% from $85.3m to $98.6m. Fairfax, which publishes The Sydney Morning Herald, The Age and The Australian Financial Review, posted a net profit after tax of $27.4m.

Again though Domain was the growth engine for the company in the first six months of the year with digital revenues climbing 36.9%, with Domain.com.au posting revenue growth of 38%, as the company noted print advertising was continuing to fall.

Domain.com.au posted revenue growth of 38%, with total revenue for the segment up 62.8%, from $94.5m to $153.9m. Domain posted an EBITDA of $65.7m, up from $37.8m.

Domain.com.au posted revenue growth of 38%, with total revenue for the segment up 62.8%, from $94.5m to $153.9m. Domain posted an EBITDA of $65.7m, up from $37.8m.

The purchase of the rest of the Metro Media business last year also saw real estate print earnings rise 24.3% from $12.4m to $15.4m on the previous year, while digital’s doubled its EBITDA from $25.4m to $50.3m.

Chief executive and managing director Greg Hywood Hywood said: “Over the course of 2015, Domain has narrowed the gap in visits versus its main competitor (REA Group). Domain’s visits grew from 18.1m in January 2015 to 39.9m in November 2015, almost halving the gap in just 10 months.”

The Domain business is housed with the company’s Australian Metro Media division which is responsible for the publication of the metro titles including The Sydney Morning Herald and The Age, print classifieds (inclusive of Domain), online classified and Australian news and transaction sites.

Metro Media saw revenues grow by 9.7% from $417.5m to $458m, with its EBITDA of $97.2m, up 14.7% on the second half of 2014.

Hywood said: “Our Metropolitan Media segment – which includes our Domain, Digital Ventures and Life Media & Events businesses – grew revenue by almost 10%.

“Contributing to this result is the very strong momentum in Domain, consolidation of MMP following the move to full ownership, growth in digital subscription revenue, and higher revenues from Digital Ventures. Consistent with recent trends, Metro publishing experienced a decline in print advertising.”

Print advertising revenue increased 10.1%, swollen by the acquisition of Metro Media Publishing Holdings at the beginning of last year, growing from $141.9m to $156.3m. Metro Digital Advertising was also up from $106.7m to $131m, growth of 22.8%. Like-for-like revenues were not broken out.

The Australian Metro Media’s revenue were also helped by modest growth across the company’s events portfolio, including the acquisition of Open Air Cinemas. Events and other non-digital revenue was up from $27.8m to $30.5m.

Print circulation and subscriptions were down from $99.5m to $95.8m, a decline of 1.3%, which was just offset by growth in digital subscriptions which went from from $15.8m last year to $18m. The company said, as of February 12, there were “around 162,000 paid digital subscribers across the SMH and The Age”.

The results come two days after the announcement of an editorial management shakeup across Fairfax’s stable of newspapers and the departure of The Age editor in chief Andrew Holden.

The company outlined its plan to focus on the Domain Group while continuing to pull away from print publishing in favour of digital, with a goal to reshape the publishing model.

“We will continue to invest in Domain in the second half and beyond. We have great confidence in this remarkable business,” Hywood told investors.

Commenting on the Metro publishing costs, Hywood said: “For the half, Metro publishing costs were down 4%, bringing the reduction in our cost base to 34% over the last four financial years. FY15 saw the full-year benefit of the closure of Tullamarine and Chullora print sites. Cost initiatives are ongoing.

“We have made it clear many times that we are managing a structural shift in publishing from print to digital. We continue to adapt our business model to this reality, which involved an intense focus on cost reduction and the creation of new revenue opportunities.

“We have managed this well over recent years and have absolute confidence we will continue to manage in the future. This will inevitably mean an even stronger emphasis on digital publishing. We are ready to meet this significant opportunity as consumer preferences demand.”

Meanwhile, Fairfax’s Australian Community Division, responsible for the publication of suburban and regional titles, agricultural and ACT publishing, continues to be hammered, posting a decline in revenue of 9% from $282.6m to $257.1m, excluding external print revenue the decline was 11.2%.

Advertising revenue for the segment was down 12.1% impacted by the decline in supermarket-related print retail advertising while circulation revenue declines, which were down 7.8% from $49.9m to $46m, reflected lower retail volumes.

Fairfax said the segment’s transformation program, which has seen the publisher axe jobs across its regional titles including the Newcastle Herald, is on track to achieve an annualised cost reduction target of $60m by the end of FY16.

Hywood said: “Progress of ACM’s transformation program can be seen in the 9% cost reduction delivered for the half. Closure of some loss-making titles has had some negative impact on revenue.”

Fairfax Media’s digital ventures, which include Weatherzone, Allure Media and HuffPost Australia, saw an increase in advertising revenue of 39.8% from $6.2m to $8.7m.

New Zealand Media posted revenues of NZ$166m, down 7.4% on the NZ$179.5m. Advertising revenue – which declined 9.2% from NZ$131.9m to NZ$119.8m – was impacted by weak market conductions in NZ. Circulation revenue in the NZ market declined by 3.3% from NZ$57.5 to NZ$55.6.

The company’s radio revenues were up 28.5% from $52.7m to $69m. The second half of last year includes the Fairfax Radio Network only, including six months of 96FM, which was sold when Fairfax Radio merged with Macquarie Radio Network.

Hywood commented: “Macquarie Media’s pleasing performance is the result of the merger between Fairfax Radio Network and MRN in March 2015. Cost and operational synergies have been implemented.

“As Macquarie Radio indicated earlier this week, it expects FY16 EBITDA will be in the range of $20m to $25m.”

Note: *Australian Community Media and New Zealand Media – Revenue includes external printing revenue (only includes in the segment slide)

The half year results saw Fairfax spruik its investment in streaming service Stan, claiming it was approaching 400,000 active subscribers across more than 700,000 households.

The half year results saw Fairfax spruik its investment in streaming service Stan, claiming it was approaching 400,000 active subscribers across more than 700,000 households.

Hywood said: “Our investment in Stan puts us at the heart of a new era of entertainment. Stan has cemented its position as Australia’s leading local subscription video-on-demand provider. Fairfax and Nine and wielding the power of their deep marketing inventory behind the business, driving strong growth.

“We are confident Stan will deliver long-term value for shareholders. The recent exclusive multi-year deal with CBS’s Showtime makes Stan the official home of Showtime in Australia and underpins confidence in this business.

“Make no mistake, this was a game changer. The Stan deal was part of Showtime’s global distribution strategy and recognises Stan’s strong competitive position in this emerging market. Only a year old, Stan has established itself and met is business targets, with more than 700,000 households signing up to the service. It is approaching 400,000 active subscribers. Stan has rolled out applications on every major streaming device.”

Related: Stan’s $30m Showtime output deal: Has streaming boss Mike Sneesby ‘burnt his boats’?

Fairfax warned revenues for the first seven weeks of the year were 1% to 2% below last year, however focused on Domain.com.au’s continuing strong performance, with organic revenue growth of 25%.

The publishing company said it will continue to focus on Domain’s strong growth, driving its emerging businesses and delivering its cost reduction programs.

Miranda Ward

Linkedin

Linkedin

Fairfax must be petrified at the near consensus in politics to rein in house price inflation. A contraction in transaction would hammer it’s only business and on these numbers would kill its newsrooms.

User ID not verified.

If all that is good news, why is the share price tanking so badly right now?

User ID not verified.

Domain – hurry up and IPO. The market wants it. Fairfax just needs to let their prized asset free.

User ID not verified.

I don’t think they should IPO Domain to me it seems like it is a symbiotic relationship between the newspapers and Domain. Domain needs the newspapers to keep writing endless domain stories and funnelling traffic through to it and the newspapers need Domain to keep them viable.

User ID not verified.

@ Newson — but if they sold off Domain, there would be nothing (of any great value) left of Fairfax. Domain is the only thing propping this business up right now. Do the math: Total Fairfax EBITDA grew by $13m. Domain’s EBITDA grew by almost $30m. Take that out of the equation and Fairfax’ total EBITDA would have actually gone backwards significantly.

User ID not verified.