News Corp annual profits fall by 28%; digital real estate beats news as main source of profit

News Corp has revealed that its global profits slid by almost 30% in the 2016 financial year, thanks to a dramatic drop in profitability in its news operations around the world.

However, the fall has been partly offset by a rapid growth in the company’s digital real estate operations, which include REA Media.

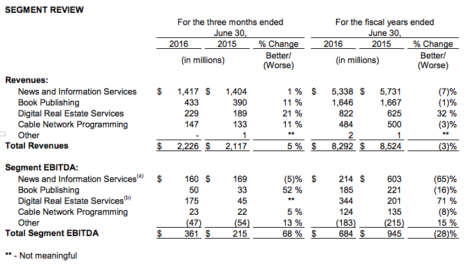

The company, which locally publishes newspapers The Daily Telegraph, Herald Sun and The Australian, and owns half of Foxtel, reported global revenues for the financial year of US$8.3b, down 3% on the previous year.

However, in the final quarter of the year, the company’s revenues grew by 3% compared with the same period. But this was driven by this year’s quarter having an extra week.

In one significant milestone, the company’s real estate operations are now more profitable than its news business.

While its news operation’s profits fell from $603m to $213m in the full financial year, its digital real estate profits rose from $201m to $344m.

Indeed, more than half of the company’s $684m profits now come from digital real estate, with book publishing accounting for $185m and cable network programming $124m.

The profit results includes a one-time charge of US$280m for the settlement of litigation and related claims at News America Marketing and a one-time gain of $122m for the settlement of the Zillow litigation. Excluding those settlements, EBITDA would have been US$842m.

Robert Thomson, News Corp CEO, said in an accompanying statement the company has “made clearly progress on our primary goals – to become more digital and more global”.

“Since the advent of the new News three years ago, revenue at Digital Real Estate Services has more than doubled, and it is expected to become the biggest contributor to EBITDA in the future thanks to the ongoing success of REA and the rapid growth at Realtor.com in the US,” he said.

There were few clues in the update on how News Corp’s Australian newspapers are travelling, as the results are not separated from its US and UK operations.

But Thomson did say: “While global print ad trends remain challenging at our News and Information Services segment, we are continuing our aggressive growth in digital, which now accounts for 23% of segment revenues, up from 19% last year.”

News Corp’s News and Information Services segment – which includes most of the company’s Australian operation – was the hardest hit, with revenue for the financial year down 7%, from $5.731b to $5.338b.

Advertising revenues declined 11% in US dollars which the company said was exacerbated by the weakening Australian dollar. Circulation and subscription revenues were down by 2%.

News Corp attributed the decline in the segment to lower revenues and higher promotion and marketing costs in the UK.

The publishing company also released the digital subscriber trends across the segment for the final quarter of the financial year, with digital subscribers across News Corp Australia’s mastheads totalling 272,700, compared to 225,600 in the prior year. It did not reveal subscriber revenues though.

Thomson said: “Finally, at News Australia, The Australian continues to post higher paid volume, thanks to digital.

“With the advertising marketplace in upheaval, and rightly under increased scrutiny, we believe the need for trusted content and premium audiences will only increase.

“We are confident that News Corp’s unique portfolio and global distribution, combined with our focus on cost efficiencies, mean we are uniquely positioned to capitalise on broader social and commercial trends, and drive long-term value for investors.”

Pay TV operation Foxtel, which News Corp jointly owns with Telstra, saw profits fall from $441m to $373m.

The platform also saw a dramatic jump in subscriber churn in the final quarter – leaping from 9.9% to 14% of customers.

The period coincided with the rise of rival services Netflix and Stan and news of Foxtel’s loss of live EPL games.

However, News Corp said the reason for the churn was “the increased use of no-contract offers”; across the full financial year, customer churn rose from 10.9% to 12.2%.

However, across the year, Foxtel revenues increased 3% due to higher subscribers, with the company stating that its subscribers, as of June 30, were “more than 2.9m”.

Meanwhile, The company’s book publishing saw its revenues decline by $21m (1%) compared with the year prior, with the segment’s EBTIDA for the year decreasing by US$36m (16%).

- Next month’s Publish conference, organised by Mumbrella, will see The Australian CEO, Nicholas Grey, share the story of the masthead’s digital transformation.

Linkedin

Linkedin

So revenues for the News and Information division have gone backwards 7% in the year, but the EBITDA for same division has plummetted by 65%. What’s happening to their cost base? Higher marketing and promotion costs, indeed……sounds like they’re spending up a storm in a desperate attempt to hold back the tide of dwindling readership.

User ID not verified.

Clearly the revenue is coming with low margin. Is this what native advertising looks like? Also note that both Fairfax and News are resting on the Australian real estate bubble and the RBA is trying to blow that up.

User ID not verified.

The low margin revenue gain might be a function of native ads? And it’s worth noting that both news and Fairfax are reliant on the Australian housing bubble.

User ID not verified.

Real estate agents only have so much to spend on digital advertising and at the top of the bubble where we are now, they are spending the most they ever will. When the bubble bursts (as all bubbles have throughout history), digital revenue will be heavily impacted. Vendors it seems are already pushing back at being asked to spending over $2,000 for a premium digital listing and the real estate agents isn’t going to fund this cost from their own pocket.

User ID not verified.