News Corp CEO admits to ‘challenging’ ad market as Rupert Murdoch’s pay packet falls

News Corp CEO Robert Thomson has admitted advertising remains a challenge for a number of the media company’s businesses but flagged programmatic trading and increased video and mobile uptake as growth drivers for the company.

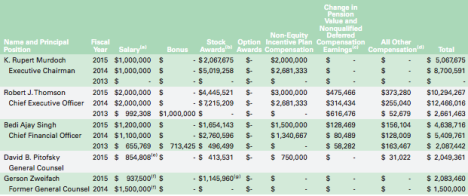

The comments were made in Thomson’s message in News Corp’s Annual Report, released to the Australian Securities Exchange (ASX: NWS) this morning, which revealed the Australian earned US$10.29m, with News Corp co-chairman Rupert Murdoch taking home US$5.07m.

“Advertising remains challenging for a number of our businesses, particularly in the UK,” wrote Thomson, who last month accused Google of “piracy, zealotry and kleptocracy” in a speech at the Lowy Institute Media Awards.

Thomson said the company is addressing the advertising challenge “with new products to encourage engagement and drive digital subscriptions”.

“We plan a deeper role for our programmatic ad exchange and increased monetization of video and mobile, which we believe are key drivers of future growth.”

News Corp Australia announced its Australian programmatic play at its upfront ‘Come Together’ event at the end of July which sees the company partner with Multi-Channel Network (MCN) to create the Multi-Brand Exchange (MBX).

“On many contemporary digital sites, there is much reader promiscuity, with the relationship extending to mere drive-by traffic; for our mastheads, there is much greater reader affinity and intensity, both of which are crucial ingredients for successful marketing.

“On many contemporary digital sites, there is much reader promiscuity, with the relationship extending to mere drive-by traffic; for our mastheads, there is much greater reader affinity and intensity, both of which are crucial ingredients for successful marketing.

“The advertising market is in the midst of disruption, but there is little doubt that the long-term benefits of powerful platforms and relationships will become clear to advertisers.

“That said, our companies are continuing to innovate to provide better service to our clients and deliver measurable results.”

Thompson also echoed some of the fears articulated by WPP boss Sir Martin Sorrell last week about problems facing the global economy.

The News Corp CEO wrote: “As is the case for all companies with extensive global operations, there has been a significant impact from currency fluctuations. With the US Federal Reserve on the cusp of an interest rate increase, volatility in Europe and uncertainty about China’s trajectory, there will likely be more volatility in the current year.

“Our current aim, currencies aside, is to purse our core digital strategy, develop our businesses and prudently cut costs to ensure that there is a long-term and meaningful return for our investors.”

Commenting on Australia specifically, Thomson touted Fox Sports’ signing of the AFL sports rights with the Seven Network.

“Fox Sports has successfully monetized its first class roster of sports rights, and is benefiting from Foxtel’s new pricing and packaging strategy to drive subscriber growth,” Thomson wrote.

“At Foxtel, we also expect the rollout of Triple Play and improved content offerings at Presto, its SVOD product, to be accretive to growth. Foxtel also announced plans to acquire an approximate 15 per cent stake in Ten Network Holdings Ltd, subject to regulatory approval.”

Thomson highlighted the improved EBTIDA at the company’s local publishing business which he said was “thanks in part to measured increases in both cover price and subscription rates, more digital offerings and the efforts by the sales team to stabilise advertising trends”.

News Corp reported a financial year loss of US$149m ($201.7m) amid various write-downs and impairment costs but unusually made no specific mention of the performance of its Australian newspaper businesses or market conditions in its result statement.

“Our leadership team in Australia is continuing to develop our mastheads, which are powerful platforms for advertisers in print and digital. They have launched new apps for our Australian papers and continue the development of news.com.au, the country’s largest news website,” Thomson said.

“The Australian economy has been in flux, in part because of a slower growth rate in China and the resulting impact on commodity markets, but longer-term prospects for the country, with its growing, aspirational population are positive.”

In a proxy statement uploaded to the Australian Securities Exchange alongside the Annual Report, News Corp revealed the total compensation for executive chairman Rupert Murdoch and CEO Thomson both fell in the year ended June.

While both Murdoch and Thomson’s base salaries remained unchanged, at US$1m and US$2m respectively, Murdoch’s total compensation was US$5.07m for the financial year ended in June, down from US$8.7m a year earlier.

Thomson’s total remuneration for the financial year just ended stood at US$10.29m, down from US$12.46m a year before.

The drop in compensation for the senior executives is due to a decline in stock awards, with Murdoch’s stock awards down from US$5.019m to US$2.067m while Thompson’s stock awards were down from US$7.215m to US$4.445m.

Lachlan Murdoch, the other co-chair of News Corp, had a director compensation package of US$225,000 – US$100,000 in cash and US$125,000 in stock awards.

Miranda Ward

Linkedin

Linkedin

I think Thomson mentioned the improved EBITDA – not EBTIDA

User ID not verified.

Hilariously and hopelessly out of touch. These buffoons will be dragged out kicking and screaming.

User ID not verified.

Meanwhile Rebekah Brooke’s has slipped back into the hot seat in London…

User ID not verified.