News Corp reports loss amid writes-down but makes no mention of Australian newspapers

Publisher News Corp has reported a financial year loss of US$149m ($201.7m) amid various write-downs and impairment costs, including a US$371m non-cash write-down the value of its struggling education business Amplify.

Publisher News Corp has reported a financial year loss of US$149m ($201.7m) amid various write-downs and impairment costs, including a US$371m non-cash write-down the value of its struggling education business Amplify.

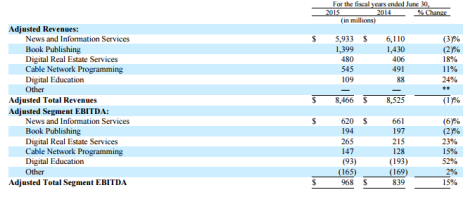

The full year result came despite an 11 per cent lift in earnings, off the back of strong growth in digital real estate businesses REA Group and Move Inc, with an EBDITA of US $852m ($1.153bn) and a one per cent rise in revenues which grew to $8.63bn.

News Corp’s news and information division, which publishes its newspapers globally, saw revenue and profits slip with revenues declining three per cent from US$6.1bn ($8.2bn) to US$5.9bn ($7.9bn) while EBITDA fell six per cent to US$620m ($839m).

Unusually the publisher made no specific mention of the performance of its Australian newspaper businesses or market conditions in its result statement.

It did however note the major impact on the earnings was $US455 million ($616.1m) in impairment and restructuring costs.

It did however note the major impact on the earnings was $US455 million ($616.1m) in impairment and restructuring costs.

The News of World phone hacking scandal also continues to impact the company with the publisher noting that EBITDA performance was impacted by US$50m ($67.7m) in “UK newspaper matters.”

“Despite an uneven global economy, very tough currency headwinds and the ongoing transformation of the media landscape, for fiscal 2015 we posted stable revenues, robust EBITDA growth and healthy free cash flow,” said Robert Thomson CEO of News Corp.

News Corp chairman Rupert Murdoch is currently visiting Australia, and held a lavish lunch on Tuesday for politicians, advertisers and media buyers.

Nic Christensen

Funny that. Meanwhile same story over at Fairfax which , per annual results just announced, is being propped up by its digital real estate business and not much else. And, just like News, no mention of how it’s newspapers are performing.

User ID not verified.

News Corp’s news and information division, which publishes its newspapers globally, saw revenue and profits slip with revenues declining three per cent from US$6.1bn ($8.2bn) to US$5.9bn ($7.9bn) while EBITDA fell six per cent to US$620bn ($839bn).

EBITDA should be in millions there, guys.

User ID not verified.

Thanks for flagging , that’s been altered now.

Cheers,

Alex – editor, Mumbrella

The core problem for news and Fairfax is the reliance on real estate. The weight of falling print revenues can’t be offset by cost reductions indefinitely. So at some point the print losses will start to mount and at that point they don’t have a business. The reason for this is that while both claim independent digital revenues the profit is still in print.

User ID not verified.

Both news and fairfax are doing the right thing by diversifying revenues and business lines to reduce reliance on print which, despite ruperts insistence , is in terminal decline. But news has a much stronger portfolio. Hard to see that fairfax can keep print going much longer. They won’t have to worry about spinning off domain – that’ll be all that’s left. It’s a good business – the only part of fairfax that really stands up

User ID not verified.

Zoopla, Trulia…

Will something launch into Aus and disrupt this space? Will a home grown platform kill the two rivers of gold that were not depleted when the tinternet killed their classies?

User ID not verified.