Gyngell

Seven West Media has sought to calm the market following Nine’s profit warning which led to a share nosedive yesterday.

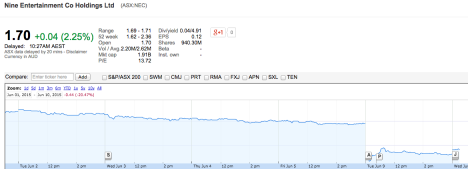

Nine shares fell nearly 20 per cent to $1.63 early yesterday before rallying in the afternoon.

It followed Friday’s profit warning which said a soft advertising market was likely to see EBITDA – earnings before interest, tax, depreciation of amortisation – for the current financial year – likely to fall to be between $285m – $290m, down on the expected $311m.

ADVERTISEMENT

Shares in Nine as of 10.40 this morning has climbed from $1.66 overnight to $1.70.

Nine’s profit downgrade prompted a statement from Seven West Media which reaffirmed its guidance for the 2015 financial year, with underlying net profit after tax expected to be between $205m to $215m.

“This guidance was provided at the release of SWM’s half year results on 18 February 2015 and reaffirmed at the time of SWM’s announcement of the early redemption of the Convertible Preference Shares and pro-rata offer on 29 April 2015,” the statement said.

“Seven’s ratings year performance has been strong delivering the largest gap to our closest competitor since 2011. The demand for key franchise programming is stronger than in the prior year and the market response to our Olympic sponsorship packages has been very positive.”

Seven shares opened today at $6.41, down 20 cents, before recovering to $6.51 a 1.51 per cent fall on yesterday.

Ten shares have remained relatively stable at around 24 cents in recent days.

Ten shares have remained relatively stable at around 24 cents in recent days.

Steve Jones