Quickflix stays in trading halt as company blames Netflix for falling subscriber numbers

Streaming service Quickflix has requested that the ASX allow it to remain in a trading halt until Wednesday as it continues negotiations with an unnamed “international” player about a potential “acquisition”.

Streaming service Quickflix has requested that the ASX allow it to remain in a trading halt until Wednesday as it continues negotiations with an unnamed “international” player about a potential “acquisition”.

The trading halt comes as the company’s latest quarterly report (ASX: QFX), put out late on Friday afternoon, shows the number of Quickflix subscribers declining on both a quarterly and year-on-year basis despite the recent explosion in consumer awareness and sign up to rival services.

Quickflix blamed “pent-up demand for Netflix in particular” for causing a sharp decline in customers early in the quarter, but more concerning for the company is its cash on hand which as of June 30 was $913,000, following its recent capital raising which brought in $775,000.

That suggests the company will require another financial investment to remain viable as the statement shows Quickflix had an operating loss of $1.096m this quarter, up from the $850,000 it lost last quarter, as revenue receipts declined 15 per cent to $4.2m.

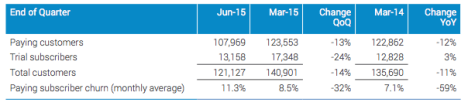

On the subscriber front Quickflix reported it had 107,969 paying subscribers down from 122,862 a year ago, a decline of 12 per cent.

More troubling for the SVOD and DVD rental company will be that the number of people trialling the service has fallen quarter on quarter from 17,348 in March to 13,158 in June, despite having spent $408,000 on marketing efforts.

Subscriber churn is also increasing with the monthly average of customers dropping the service rising to 11.3 per cent up from 7.1 per cent a year ago, a 59 per cent rise.

The quarterly report touts its recent deal to become a reseller for Foxtel and Seven West Media’s Presto service, while it has recently moved to wind back its distribution deals with studios as it continues to cut costs. However, the statement to the ASX also notes that “the deal remains conditional and Quickflix has requested an extension to address outstanding conditions”.

The change in rhetoric to one where the company is blaming Netflix and other streaming services for the decline in subscribers marks a change in Quickflix management’s view on the competitive landscape.

Quickflix CEO Stephen Langsford has previously declared, on multiple occasions, that the explosion SVOD services was good for the segment and all players including the Perth-based company.

“We have said that (marketing) will boost awareness amongst the category,” said Langsford, back in January. “Our game plan is to move the business to sustainability.

“The advantage Quickflix has is that we do have an existing customer base which is generating revenue and we do have a strong point of difference to the incoming SVOD players, in that our business is complemented by DVD rentals – not only SVOD revenue but transactional.”

Many of the major players will be watching Quickflix’s discussions including Nine Entertainment Co and Fairfax’s joint venture Stan, which has a strategic stake in the company entitling it to a $10.5m payment in the event of “a disposal of substantially all of the Company’s assets, a merger or takeover, a person other than the shareholder acquiring a voting power of more than 51 per cent in the company.”

The mention of an “international” party in the release appears to rule out a move by one of the local players while it is unclear what value a company like Netflix would take from a deal, given recent figures show it has a commanding lead in the local market.

Speculation has been rife a niche player could enter the market to target certain demographics, such as the Asian market, with content.

Nic Christensen

Related:

- Why Nine’s investment in Quickflix makes it tougher for Netflix to launch in Australia

- Quickflix places shares in trading halt amid rumours of take over

- Quickflix admits it is losing $850,000 a quarter

- Quickflix inks Presto deal which bypasses warrant held by rival Stan

- Netflix now watched by 1.42m Australians across 559,000 households, claims Roy Morgan

If Quickflix was a sick dog we would have put it down already. Quicker someone pulls the plug the less money will be wasted…well, what little money they haven’t squandered away yet anyway.

User ID not verified.

Damn those pesky competitors. Not that they were cooking with gas before their meagre morsels got turned into a feast.

User ID not verified.

so when will platform agnostic delivery of a global content license become standard?

or are the dinosaurs going to cling to the dog’s breakfast of delivery systems and licensing deals until the above and/or torrents puts them out of business?

User ID not verified.

How is Quickflix still a thing?

User ID not verified.

What maniacs invested $775,000?

User ID not verified.

It’s not that our product is bad,

it’s just that the competition is so good.

User ID not verified.

Blaming a competitor’s better product for falling earnings?

Um. That’s not an excuse. That’s just stating a fact, that your product is crap and doesn’t deserve to survive.

User ID not verified.

Rightly or wrongly, netflix is to streaming what coke is to cola. Everything else just isn’t the same

User ID not verified.

A shame QuickFlix didn’t corner the market when they were the only player, nor piggyback on all the “Netflix is coming” hype by saying “QuickFlix is already here and Australian”.

I am a supportive customer, and it is a shame to see another American multinational win due to QF’s missteps.

But ultimately, if Australians don’t support Australian owned, then the multinationals will always win.

User ID not verified.

Amazon still need a platform for their former top gear hosts show. Maybe we will see Amazon make a purchase?

User ID not verified.

Unfortunately, nobody wants to rent DVD’s in this day and age and QF’s streaming offering is sub par. Not their fault.

Content is king and they don’t have it. Foxtel do.

Now that netflix is here… game over

User ID not verified.

[Edited under Mumbrella’s comment moderation policy]the fact that they have survived ten years and now have potentially an international partner should tell you that these people arent going to quit, like you people would,lets see what happens to the shareprice tomorrow, [Edited under Mumbrella’s comment moderation policy]!

User ID not verified.

“Content is king and they don’t have it. Foxtel do.”

all Foxtel have is a bunch of local licensing deals streamed over 20th century tech, stuffed full of ads.

that’s not a business plan, it’s an admission of failure.

User ID not verified.

You know Quickflix is the only company that actually tells you what their numbers are.

Netfilx won’t and the figure of a million is pure guesswork by a survey company. Netfilx has admitted it got it wrong by offering so much free content at first and it costing them a huge amount. Stan and Presto wont give figures either and I can tell you it has cost them all many hundreds of thousands to set-up . Nobody is making money at the moment.

User ID not verified.