Staff churn, big rosters and finding audiences: the challenges ahead for media agencies

While 2015 was a big year in the media agency space the signs are 2016 will be even more significant with pitching, staff management and delivery of audience at the fore. Nic Christensen looks at the big issues facing them in 2016.

While 2015 was a big year in the media agency space the signs are 2016 will be even more significant with pitching, staff management and delivery of audience at the fore. Nic Christensen looks at the big issues facing them in 2016.

GroupM’s decision late last year to hire McDonald’s chief marketer Mark Lollback as its new CEO probably didn’t get the attention and commentary it deserved.

The appointment of one of Australia’s most prominent marketers shows exactly where the country’s biggest media agency group sees the battles for the industry in the next few years.

A renewed client focus at GroupM?

As a former chief marketer for major brands McDonald’s, ANZ and Pepsi, Lollback has a marketer pedigree largely unrivalled in this market. He also has a strong portfolio of work that has received both local and global recognition.

At a time when marketers are looking at the fragmenting media landscape with increasing confusion and uncertainty, the new GroupM CEO is more than capable of having the key C-Suite conversations that need to be had, not just with the marketing team but with the CIO, the CFO, the CEO and also the Board – demonstrating that both Group M understands the broader business strategy and what his agencies can do to help them.

This will be important after a year in which a number of the agencies within Australia’s biggest media holding group, GroupM, have taken a hit in terms of client rosters.

The problems in 2014/15 at Mediacom were well documented, resulting ultimately in Foxtel and IAG moving downstairs to Mindshare. Meanwhile, at Mindshare, it lost FMCG giant Unilever, a $59m account. Shortly after, sister agency Maxus lost the $27.5m GSK media account.

Only MEC can really be said to have had a good year in 2015 onboarding the $60m Nestle account and benefiting from the local launch of Netflix, a global client with a significant digital spend at launch (thought to be about $20m-$30m).

However, 2016 appears to have kicked off with some positive news for the agency with industry consensus that Mediacom has headed off the major threat that Westpac, its biggest client, will pitch the $70m media account in the immediate future.

However, 2016 appears to have kicked off with some positive news for the agency with industry consensus that Mediacom has headed off the major threat that Westpac, its biggest client, will pitch the $70m media account in the immediate future.

As Mumbrella reported yesterday it is thought that Westpac’s marketing team is, for the moment, focused internally on a restructure of its marketing operations, and that’s good news for Mediacom, giving its new CEO Sean Seamer and his executive team time to help rebuild the product and define a fresh vision for what is still one of Australia’s biggest media agencies.

You can bet that Lollback will also have strong views about what the vision for the wider holding group should be when he eventually takes the reins mid-year, after an extended period of gardening leave.

Mediacom is also not the only media agency likely to take the early part of 2016 as a time of rebuilding, with big changes rumoured to be occurring over at Publicis agency ZenithOptimedia.

Some of these changes are public – former CEO Ian Perrin has now departed the Australian operation (he is understood to currently be discussing options with the Publicis Group), ZO COO Andrew Sherman has also departed, as has head of digital Ros Allison.

New CEO Matt James’ first hire was also interesting – Karen Halligan, a well-respected agency executive with agency and media owner experience, and it is understood he is making major changes within the agency to its structure and operations following a series of losses. It is currently pitching to retain 21st Century Fox against a shortlist that includes Havas Media, Mindshare and Vizeum.

Are we facing a domestic “mediapalooza”?

You can expect the likes of Mediacom and ZenithOptimedia to be quite aggressive on the new business front in the latter half of 2016 once both have completed groundwork on redefining their respective product propositions.

Both will be eager to show positive momentum on the new business front and that’s important because industry insiders are increasingly speculating that 2016 could see a “domestic mediapalooza”.

For those who have forgotten “mediapalooza” was the somewhat awkward term given to the raft of global media pitches which occurred in 2015, and which put more than $250m in local billings in play in this market.

As my colleague Simon Canning and I noted yesterday, 2016 is increasingly looking like a year that will see some very big pitches on the domestic front, on both the media and creative sides of the business.

Should Coles (in its entirety) pitch, that’s some $220m. Add to that mix the likes of Westpac ($70m), Tourism Australia ($80m), Toyota ($70m), Telstra ($100m), National Australia Bank ($40m) and Victoria Government ($100m) and we, as an industry, could be looking at well over $650m up in the air in 2016.

Should Coles (in its entirety) pitch, that’s some $220m. Add to that mix the likes of Westpac ($70m), Tourism Australia ($80m), Toyota ($70m), Telstra ($100m), National Australia Bank ($40m) and Victoria Government ($100m) and we, as an industry, could be looking at well over $650m up in the air in 2016.

Now the reality is that it’s unlikely all of these accounts will pitch, but even if half of them did pitch, and there a clear signs that a number of them will/are – Coles, Toyota and Tourism Australia – we could easily hit or come close to the half-billion dollar mark this year without breaking a sweat.

Rest assured these pitches will have consequences/wreak havoc not just for the clients involved, it will also impact incumbent agencies and the raft of multinational agencies desperate for the opportunity to, as I’ve previously described it, put a “big, new, fresh piece of meat” on the table of the regional bosses. Not to mention the existing clients who will have staff diverted to work on these massive pitches.

The reality is that these local arms of multinational holding groups are likely to face tremendous pressure to have their agencies line up for what may begin to feel like a series of media pitches.

Trust and are clients moving to a wider roster?

There is also the potential for marketers to look to swing the pendulum back towards larger rosters in 2016.

We have already seen such a strategy with the $60m Optus account where the telco appointed a roster that consisted of no less than: UM (media), M&C Saatchi, Big Red, The Works, With Collective (creative), Emotive (content) RE (strategy), Thrive and Ogilvy (PR) and UK-based AKQA (which has a floating brief and is unlikely to open a local office at the moment).

That’s a hell of lot of agencies at time when marketers are showing less trust in them. It could be a way of keeping them honest – allowing them to play each other off on product and on price.

My favourite example of this was last year when Northern Territory Tourism appointed no less than 16 agencies on an $8m account.

Most marketers appoint one media agency but on this $8m media account not only did incumbent ZO retain a place on roster but it was joined by Atomic212, Foundation, Common Ventures and Optimum Media Direction. Five media agencies on a relatively small media account.

Most marketers appoint one media agency but on this $8m media account not only did incumbent ZO retain a place on roster but it was joined by Atomic212, Foundation, Common Ventures and Optimum Media Direction. Five media agencies on a relatively small media account.

As we noted last February, confusion reigned at the time of the appoint and you can fault the client for tendering on the promise of an $8m media spend and not revealing that each project would be fought over. But that wasn’t the major issue.

What still astounds me is not that the marketer drove a hard bargain, that’s why procurement departments exist, but that the media agencies went along with it and were willing to play ball when they had originally provided rates and service promises on X spend only to find it would only be X spend if they beat out four other agencies on every single project.

If media agencies are willing to do this on one $8m account I shudder to think what compromises they might be willing to make on a $40m, $70m or $220m media account.

Even when marketers appoint just the one agency for media, turf wars are to be expected on expanding rosters with growing competition over many of the new revenue streams such as digital/programmatic (increasingly being done in-house by the bigger clients), content marketing and social.

The challenge of staffing and delivery of audience

When agencies cross the line and drop their pants for new business the account invariably ends up under-serviced by junior staff, who are ultimately forced to work ridiculously long hours for relatively poor pay. This frustrates all concerned.

The client is angry because their business is being handled by a 22-year-old, there is constant churn, with young staff tired of the work and poor pay lured easily elsewhere and media agency management constantly searching for mid-level staff, eventually resorting to promoting young staff to mid-level roles too soon and without proper support.

And I’ll throw one more into the mix here: Summer has seen a dearth of quality TV viewing in prime-time with viewers fed largely a buffet of Border Security, Big Bang Theory and CSI repeats.

Indeed, the only thing that has consistently rated over the summer has been Ten’s Big Bash.

This was fine in the past because viewers had limited options outside of the local DVD rental store.

But 2015 was the year when the media landscape changed significantly and today audiences have other options, with Netflix, Stan and Presto stocking libraries of quality content that is readily available. As we noted at the end of 2015, last year saw very real and clear declines in TV audiences.

And as it stands currently, so far the TV networks and Oztam have failed to deliver clear and tradable digital numbers on catch-up and live streaming.

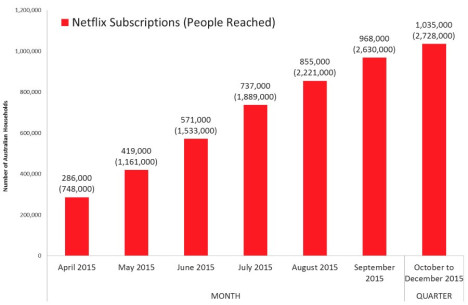

At the same time SVOD continues to grow, albeit at a slowing rate. Presto and Stan continue to decline to provide the market with numbers of paid subscriptions whereas Netflix has achieved a reach of more than 2.7m Australians in less than 12 months of operations – according to Roy Morgan’s numbers at least.

Some will say these services don’t carry advertising so why should this matter? Well, it matters because viewers now have an alternative when they are being served the 27th re-run of Border Security in a week.

It wouldn’t surprise me if SVOD services saw a spike in traffic over summer, and the real question for media agencies and owners alike is will the audience return in full when the TV Ratings year returns officially on February 7.

For media agencies that have clients incredibly focused on reach and frequency, 2015 was a year when they saw audience waterlines for key demographics fall significantly.

As we return from the summer break many are asking has SVOD caused the audience waterline to lower even more? I don’t know the answer but I do know it will be interesting to watch what happens next – for media agencies, marketers and media owners alike.

Nic Christensen is the Mumbrella’s media and technology editor