STW Communications enters trading halt with WPP poised to finally complete takeover

WPP could take control of Australia’s largest listed advertising and communications company, STW Group, as early as next week, Mumbrella understands.

WPP could take control of Australia’s largest listed advertising and communications company, STW Group, as early as next week, Mumbrella understands.

STW (ASX:SGN) has this morning placed its shares into a trading halt on the Australian Securities Exchange, ahead of an announcement.

It is understood WPP, which currently holds 23.65 per cent of STW, is set to take 60 per cent of the company. It is believed the companies have been going through due diligence for the past two months.

It is understood no cash will change hands in the move, and operations of WPP and STW will come under the same banner.

Asked if the takeover, which is expected to be billed as a merger, was imminent, WPP CEO Sir Martin Sorrell did not deny the speculation, saying to Mumbrella: “If there was any real news, we’d let you know”.

However in a statement to the ASX this morning STW said it had suspended trading in its shares “pending the release of an announcement by the company”. It will stay in a trading halt until at least December 15.

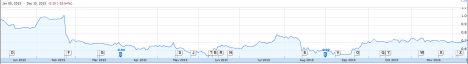

Shares were trading at 72.5c giving the company a market capitalisation of $306.87m. This year STW has traded at a low of 55c.

STW owns part or all of some 70 companies including Ikon Communications, the White Agency and Tongue, as well as a minority stake in media agency Bohemia. It partners with WPP in the Ogilvy, Mindshare and JWT businesses.

At the same time WPP is parent of dozens of agencies including GPY&R, Mediacom, Group M and Grey, and is the world’s largest marketing services holding company.

WPP recently lifted its share from 22.44 per cent through STW’s dividend reinvestment plan.

STW first floated as John Singleton Advertising in 1993, with shares trading at $1.25.

WPP first invested in the company in 1998 and STW when the lead agency was rebranded as Singleton Ogilvy & Mather. STW later took a minority 49 per cent stake in JWT.

Both 2014 and 2015 have been challenging years for the group, with chairman Rob Mactier describing 2014 as a ”challenging, difficult and disappointing year”.

Connaghan described the year as simply “not good enough”.

This year STW embark on a complete strategic review, appointing an executive council to oversee changes to each division.

The review also saw STW embark on a plan of divesting some agencies (The Conscience Organisation was returned to private ownership last week) and a number of other entities in the company are in the process of being merged along strategic lines.

In its half year results net profit after tax was down 22.5 per cent and even though operating cash flow was up, the group reported a loss of $73.4 million. Earnings per share slipped 24.9 per cent.

Earlier this year investment website The Motley Fool put STW on its list of companies it expected to be the target of acquisition in 2015. At the time STW was trading at 89.5 cents.

Speculation on a possible move by WPP on STW has been a regular theme since the two businesses began their partnership although this is the first time there has been detail of the structure of the deal.

WPP Australia and New Zealand chairman Geoff Wild, who was the engineer of the orginal deal that brought Sorrell and STW together, declined to comment on the possibility of an announcement, saying although it had been suggested to him on a regular basis he would not talk about the two publicly listed companies.

Simon Canning

Never saw this coming, oh no, totally blindsided, lol.

User ID not verified.

Lifejackets everybody.

User ID not verified.

Welcome news, but on the other hand the prospect of job losses would be high – and that’s very unfortunate.

One can hope any losses would come from the area of the business that has consistently underperformed – the leadership group & board.

User ID not verified.

Gonna get ugly

User ID not verified.

Well i guess i should update the resume…

User ID not verified.

The Indy agencies will benefit from consolidation. Expect a pitch frenzy in 2016

User ID not verified.

Is tongue an agency or a hobby?

User ID not verified.

If its not bad enough already, can you imagine how much more of managements time will be taken up with financial reporting at O&M,JWT,Y&R/Patts. I feel sorry for them.

User ID not verified.

This should have happened years ago – or at least when the price was at 55cents.

User ID not verified.

Once the announcement is made wait for the STW announcement of “business as usual” with minimal changes and then the wave of job cuts. Run…Forest…Run!

User ID not verified.

Strengthens GroupM’s position significantly….Ikon and Bohemia will help the losses at Mediacom

User ID not verified.

Job cuts, mergers and divestments here we come.

User ID not verified.

Don’t worry – Noel will have jobs for anyone cast adrift by this happening.

User ID not verified.

STW is well undervalued by the market and Sorrel comes in just before the next set of results that will no doubt show the start of a turnaround. This is bad for investors and staff alike.

User ID not verified.

Sun will still rise. Won’t it?

User ID not verified.

All your sub-par agencies are belong to us.

User ID not verified.