Ten to raise $230m in capital, concedes ‘our execution has been poor’

Struggling broadcaster Ten announced at its AGM in Sydney this morning that it plans to raise $230m in capital from shareholders.

Struggling broadcaster Ten announced at its AGM in Sydney this morning that it plans to raise $230m in capital from shareholders.

The news comes after Ten suspended trading of its shares yesterday.

A company overview from non-executive chairman Lachlan Murdoch reads:

- At our last shareholder AGM the Board discussed the programming investments being made as a result of the cost reductions implemented during 2011

- Ten performed adequately until August with returning shows such as MasterChef, The Biggest Loser and Offspring combined with some strong US content such as Homeland and Modern Family providing a good foundation

- The Board undertook a $200 million capital raising in June to reduce debt and to allow for investment in new shows

- In the first quarter of FY13, the advertising market has continued to be weak and uncertain, and within that market, our execution has been poor

- In September the Board requested management to further review the cost base to improve EBITDA performance for FY13 and be in line with covenants

- To be prudent, the Board has decided to reduce Ten’s debt by $210 million by undertaking a capital raising of $230 million

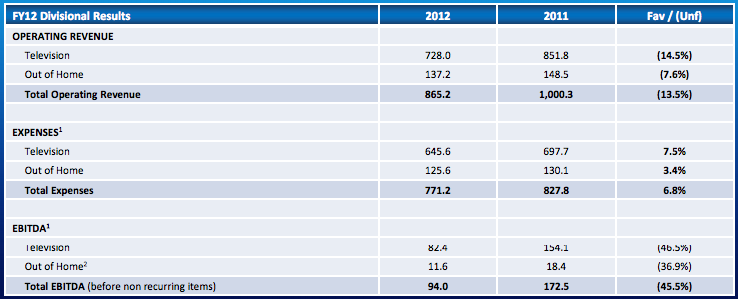

Ten’s full year financial results:

More to follow

It is shame that Channel 10 has not found it s footing ( right product mix) in a dying industry.

Anything to compete against the “other two” tired offeringswould have been a welcome relief . In the end market forces — the Social Media store that is in the offing; that will will see all media been socilaised is inevitable with web 3.0.

Brave try Channel 10 !

There must be something innovative you can do ?

User ID not verified.

Ten’s 2013 lineup includes:

“Everybody Sell Channel 10 Shares Now”

“Everybody Send Lachlan Back to Business School Now”

and

“Everybody’s Redundant Now”

User ID not verified.

Ten can/should do cartoons in the morning.. Two person infomercial/chat show till noon. USA soap City till 5pm. News till 630pm,. Simpsons and Neighbours till 730pm. Then Masterchef and what other infotainment they can find till 830pm Then 830 to midnight USA/UK/Aussie entertainment. There is still a lot available. Then Midnight till 6am infomercial city..

Weekends grab any sporty and comedy bits you can. Just keep it the same each weekend.

I can sell the ratings that above achieves and sell the infomercial space. The $$$’s you get back will coover the cost and keep above going and generate a couple of dollars to keep the execs in Midori and Pineapple Teas.

User ID not verified.

The execution has been poor but so have the ideas.

User ID not verified.

Just about everybody knows what the problem is. Some should tell Lachlan so he can fix it.

User ID not verified.

Wake up Channel Ten!

The best reality TV show ever is playing out in the TEN corridors right now and they haven’t even turned the cameras on.

It’s the “Rich Brats Blow Daddy’s Cash” show.

The second series could be “Gina, James and Lachie “own” Centrelink.

Spinoff series’ would surely follow.

Australians would flock back to TEN for the GIna Rinehart $2 a day cooking show. Sunday nights would be a given with James Packers Theology Hour. Lachlan’s gift to Australian TV would be a forensic media show – maybe Levishon’s Silent Witness.

Bring on the wailing and gnashing of teeth.

User ID not verified.