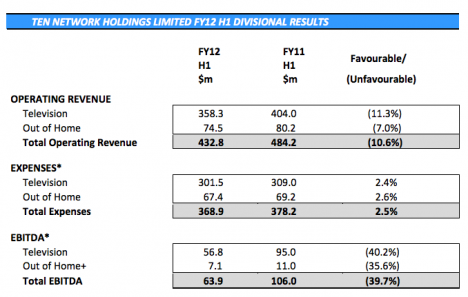

Ten’s first half results: revenue falls 10.6%, EBITDA down 39.7%

Ten has announced a 10.6% drop operating revenue and an almost 40% plunge in EBITDA in its first half results.

Ten boss James Warburton said the results “reflected the tough conditions in advertising markets during the six-month period.”

The announcement from the network in full:

The announcement from the network in full:

Ten Network Holdings Limited (Ten Holdings, ASX: TEN) today announced its results for the six months to February 29, 2012. The results included:

Ten Holdings’ Chief Executive Officer, James Warburton, said the results were in line with the guidance provided to the market on February 22 and reflected the tough conditions in advertising markets during the six-month period.

“Advertising markets were soft, particularly in late 2011 and early 2012,” Mr Warburton said. “The difficult state of advertising markets is reflected in our results for the six months to February 29. These results, however, reflect the benefits of the Operational and Strategic Review that took place last year, in particular around cost disciplines, and the ongoing efforts to create a strong platform for Ten Holdings.

“The turnaround of Ten Holdings is continuing. Our focus is on the broadcasting fundamentals of ratings and revenue. We are making good progress on both fronts, but the full benefits of the turnaround will take some time to filter through to results,” Mr Warburton said.

In line with our recent guidance, television costs were reduced by 2.4% during the six months to February 29, while costs in the EYE Corp out-of-home division were down 2.6%. Television costs for FY 2012 are expected to be approximately 5% or $30 million below the prior year, including a $14 million reduction in program costs due to onerous sports contract provisions incurred as at August 31, 2011.

Television: now

Mr Warburton said the Operational and Strategic Review that started in 2011 had now been successfully implemented across the organisation. “Ten Holdings’ cost base has been reduced. The evening news and current affairs strategy has been refocused. ONE has continued to show strong audience and revenue growth since it was relaunched on May 8 last year,” he said.

“This year we are seeing good audience growth with our 5pm to 8pm strategy and with our Super Sunday program line-up, which has had an immediate impact.”

Network Ten’s three-channel, prime-time total people audience has increased 1.6% this year. “While we are realistic about our ratings challenges, we have seen good improvements in parts of the primary channel’s program schedule,” Mr Warburton said.

TEN’s Sunday night total people audience has increased 9.6%. TEN’s Monday-to-Friday early evening (5pm to 8pm) audience is up 8.3% among people aged 18 to 49 and up 3.3% in total people.

“The foundations of our prime-time schedule have been re-set. Now we will build on those foundations, slot by slot, program by program,” Mr Warburton said.

“We have built a new executive leadership team in a short space of time. That team is now completely focused on improving the performance of Ten Holdings.”

Television: the future

Mr Warburton said recent initiatives such as introducing basic sales disciplines and new yield management initiatives, and establishing a new, in-house creative development unit were logical extensions of the Operational and Strategic Review.“Implementing the strategy we have for Ten Holdings will require vision and patience,” he said. “A key element of that strategy is increasing our share of television revenue by focusing on selling excellence and building the CONNECT coalition, our cross-media marketing platform.

“Other key elements include producing more top-rating local television shows that we own, and reinforcing TEN’s unique brand principles,” Mr Warburton said.

EYE Corp

Mr Warburton said EYE Corp’s results for the first half of FY 2012 were affected by difficult trading conditions in the pre-Christmas out-of-home advertising market in Australia and New Zealand.On a continuing operations basis (ex Singapore Airport and Adval), revenue was up 6.5% year on year. Tight control around costs has continued, with operating costs down by 5.5% in the first half.

Over the past six months, EYE Corp has secured several key contract wins or renewals, including Qantas, Brisbane Airport and Sydney’s Glebe Island silos. Industry figures indicate EYE Corp’s Australian division gained market share during February and March following a disappointing summer period.

On March 19, Ten Holdings issued a statement to the Australian Securities Exchange that it was undertaking a strategic review and considering strategic options for EYE Corp.

That strategic review is continuing and there is nothing further to update the market on at this point in time. There is no certainty that the strategic review will result in a transaction or that any transaction will be completed.

Interim dividend

As announced on February 22, the Board has decided that due to the difficult market conditions it is prudent that no interim dividend will be paid.Outlook

The television advertising market remains “short”, with limited visibility in terms of forward ad

bookings, but Ten Holdings is improving its competitive position.Although the out-of-home advertising market has been – and continues to be – more resilient than some other sectors of the media industry, it is also experiencing shorter ad booking cycles.

“A lot of hard work was done last year to re-set Ten Holdings’ cost base and create a more sustainable business. Further investment in programming will be required,” Mr Warburton said.

“While visibility remains limited, we expect to see less volatility in advertising markets over the next few months and the emergence of a more consistent trend.”

In whose interest would it be for TEN to become less expensive…?

User ID not verified.

watch Warburton do a Leckie and artificially deflate everything for the first year so he can do the rock star turn and take credit for MASSIVE growth in year two and three.

User ID not verified.

/sigh

It’s not a “tough market,” – it’s a complete change in how people access content.

I feel really sorry for the employees of companies run on 20th century business strategies. The time to evolve was ten years ago, now it’s too late.

User ID not verified.

With the growth of YouTube and internet-based display products such as AppleTV – combined with businesses now shifting their advertising spending towards online audiences – I can’t see how these numbers will EVER improve…

If the NBN is rolled-out successfully – and high definition video is able to be reliably streamed into loungerooms – I don’t see any future for TEN – who appear to have no clear strategy for how to extract the same (near) $750m in annual revenue from online audiences that they’ve traditionally received from broadcast advertising.

Nothing in life is forever.

User ID not verified.

Turnaround…what turnaround. Cost are virtually the same only 2.4% less than the same time last year even after a $85m write-off last year. As for revenue, they have dropped from a 29% share to a 24.5% share – some $120 pa lower than before. I thought Murdoch had promised 30% share not 24.5% ! He will probably claim Eleven as well, but memory says the previous management had launched Eleven not Murdoch or Warburton. Glad I bought Ten shares a few years ago – not !

User ID not verified.

Maybe if Ten stopped showing a million ads during their programming, it might be an easier network to watch. I am positive they have breached the number of permitted ads within an hour on COUNTLESS occasions. And I may be wrong, but it certainly seems like they are worse than the others.

User ID not verified.

Time for a government handout to prop up FTA TV, another dinosaur like Holden.

No wait, that already happened.

User ID not verified.

I always read with interest when the “on-liners” predict the death of TV.

Perhaps TV is king. Perhaps It will continue to be the best way to build brands and sell what we in adland need it to. And Ten is a critical part of the TV landscape.

Perhaps new media is not the future of our industry. Perhaps a bigger band wagon has never suckered so many unthinking disciples along for the ride. Well not since the Emperors New Clothes.

User ID not verified.

wonder how much fun Neil Shoebridge had with that as his first set of results.

User ID not verified.