WPP takes controlling 61 per cent share in STW creating Australia’s biggest marketing group

Australia’s largest agency holding group STW Communications has confirmed a “merger” with the world’s largest holding group WPP.

STW went into a trading halt on Friday when Mumbrella revealed it was deep in negotiations for the tie-up with WPP, led by Sir Martin Sorrell, with today’s announcement confirming it now had a controlling 61 per cent stake in the company.

The deal values STW’s business at around $512m, with new shares being issued to WPP at 91.5c each, 30 per cent more than their value when they went into the trading halt on Friday.

STW is maintaining there will be no job losses despite the deal being forecast to find efficiencies of around $15m per year through shared services, with the combined group expected to have around 5,500 employees.

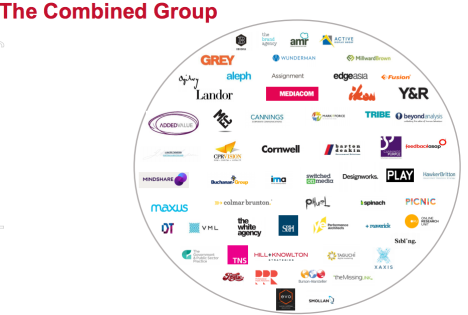

STW owns part or all of some 70 companies including Ikon Communications, the White Agency, The Brand Agency and Tongue, as well as a minority stake in media agency Bohemia. It partners with WPP in the Ogilvy, Mindshare and JWT businesses.

STW owns part or all of some 70 companies including Ikon Communications, the White Agency, The Brand Agency and Tongue, as well as a minority stake in media agency Bohemia. It partners with WPP in the Ogilvy, Mindshare and JWT businesses.

At the same time WPP is parent of dozens of agencies including GPY&R, Mediacom, Group M and Grey, and is the world’s largest marketing services holding company.

According to details of the deal released to the ASX this morning it is expected to create a group with “normalised net sales” of $847m per year.

Michael Conaghan will stay on as CEO of STW while Robert Mactier will remain chairman.

Mactier said in the release: “Bringing together the respective iconic brands and wonderfully talented people of STW and WPP Australia and New Zealand under a single common ownership and will unlock tremendous local and global capability, experience and efficiencies for our clients as well as establishing a fantastic platform for our people to prosper.

“The transaction is EPS accretive as a result of the issue of new STW shares at a premium to market and also delivers a material reduction in STW’s leverage and the opportunity to unlock a range of synergies thereby creating significant value for our shareholders. Importantly, binding governance protocols and shareholder protections have been agreed for the benefit of the continuing minority stakeholders.

“I consider this a genuine win-win transaction for all our stakeholders. Post completion, we look forward to working seamlessly with WPP as our major shareholder and strategic partner as we embark on the exciting journey that is in front of us.”

Connaghan described the deal as making “great sense” adding: “To finally align our shareholdings in those existing partnerships (J Walter Thompson, Mindshare, Maxus and Added Value) and now to expand our relationships across the full STW and WPP Australia and New Zealand portfolio of companies is an amazing opportunity.

“WPP is the leading player on the global stage in our industry. We have the potential to create a group unparalleled in this part of the world, totally focussed on our home markets, but allowing our clients and people open access to the best thinking on a global level.”

Australia is WPP’s fifth largest market globally, with the group claiming sales of $429m in the release to the ASX.

CEO Sir Martin Sorrell added in the statement: “The merger of our Australian and New Zealand operations with STW, will give us a unique opportunity to offer our local and international clients a comprehensive set of services and to make sure we can offer the best talent through country management.

“It will also enable STW to focus on the Australian and New Zealand markets, which it knows best, with a structure that will strongly incentivise its people.”

It is understood STW will continue to operate its businesses in Asia.

Both 2014 and 2015 have been challenging years for the group, with chairman Rob Mactier describing 2014 as a ”challenging, difficult and disappointing year”.

Connaghan described the year as simply “not good enough”.

This year STW embarked on a complete strategic review, appointing an executive council to oversee changes to each division.

The review also saw STW embark on a plan of divesting some agencies (The Conscience Organisation was returned to private ownership last week) and a number of other entities in the company are in the process of being merged along strategic lines.

In its half year results net profit after tax was down 22.5 per cent and even though operating cash flow was up, the group reported a loss of $73.4 million. Earnings per share slipped 24.9 per cent.

Earlier this year investment website The Motley Fool put STW on its list of companies it expected to be the target of acquisition in 2015. At the time STW was trading at 89.5 cents.

Speculation on a possible move by WPP on STW has been a regular theme since the two businesses began their partnership although this is the first time there has been detail of the structure of the deal.

Simon Canning and Alex Hayes

Let’s be clear, this is not a merger of equals. Mike Connaghan and the Executive Team at STW shouldn’t keep their jobs moving forward. Describing 2015 as “not good enough” by STW’s CEO sounds ok as a quote but it highlights the lack of accountability from a holding co perspective. The pressure that STW puts on co leaders is immense and ruthless and its ironic that the STW top leadership emerge unscathed from this process. Incredible when you think about how the network has underperformed under their watch.

User ID not verified.

Totally agree with @Michael.

Performance at STW has been average at best and frankly the business leadership is old-school and unsophisticated.

I can’t see MC staying around. [Edited under Mumbrella’s comment moderation policy]

User ID not verified.

so who do you want to lead it then ? an over seas person with dubious international experience ? How long did it take WPP to replace Steady .. who exactly would step in and have the influence Mike has ?

User ID not verified.

Buy Enero for loose change and there’s a built-in leader….

User ID not verified.

@Geronimo; Are you serious? There’s half a dozen Australians domestically and internationally that could do it.

Give me a break.

If your position is no one else could do it so he should stay then I’m lost for words.

User ID not verified.

A fresh set of eyes would definitely be a good thing.

One minute there is talk of “synergies”, the next “no redundancies” – hmmmmm…..

User ID not verified.

Mike will hang around to oversee the “merger” and “unlock synergies” then eventually “leave” to “pursue new opportunities” or “enjoy more time with family”.

User ID not verified.

Win win? What nonsense. There is rarely a merger of equals, rather a victor and victims. And the victims are the staff, followed by the clients.

If there are to be no job losses why not guarantee staff their jobs with a contract?

No? Thought not.

If you are not one to f the favoured few, and they know who they are, polish your resume, and dust off your life jacket.

User ID not verified.

What influence? Mike makes an appearance at shareholders meetings, and rarely sticks his head up in between appointments. An industry leader you think? He doesn’t have the profile of a Sorrell or a Levy and closer to home the likes of Atlassian and Xero are far more endearing companies from an innovation/tech leadership perspective.

Meanwhile, someone still has to be held accountable to the Asia expansion strategy that was so ill conceived.

User ID not verified.

This deal is long overdue and irrespective of who leads it short term (housekeeping chores have to be completed) the changes will come thick and fast in 2016.

Those agencies that were previous split in their allegiance between WPP and STW stakeholders will benefit the most. Namely Mindshare, Ogilvy & JWT who aren’t nearly as successful locally as their international namesakes. I’d expect a refresh, secondments on key accounts and a renewed focus on the product.

As for the various smaller outfits they’ll be merged / rebranded and you’ll most definitely see a roll out or expansion of WPP brands that can capitalise on existing global relationships and roster.

User ID not verified.

is Hamish McLennan free?

User ID not verified.

@fleshpeddler no, but $2 will get him.

User ID not verified.

No. He costs about $8 million a year

User ID not verified.

I suggest it won’t be long into 2016 until Sir Martin’ bean counters fly in and cut loose on the current Management team. As for Mr McLennan, he’s Lachlan’s boy and wherever he appears next it will be linked in some way to the Evil Corp regime.

User ID not verified.

Buckman

User ID not verified.