ARN parent company HT&E reports a 82% fall in net profit and a $59m loss

The COVID-19 pandemic has continued to wreak havoc on the media industry’s financial results with Australian Radio Network (ARN) parent company Here, There & Everywhere (HT&E) posting a $59m loss and a fall in net profit after tax (NPAT) of 82% for the second half of the FY20 financial year.

Chairman Hamish McLennan said the company’s fundamentals were still strong and pointed to undrawn debt.

“The fundamentals remain strong with the underlying business making a profit for the half and maintaining an industry leading balance sheet with $90m of cash reserves and $251m of undrawn debt, providing HT&E with flexibility and alternatives for growth,” he said.

“ARN is weathering the storm, with overall radio listenership increasing, and streaming and digital audio consumption growing.

McLennan said the company ‘moved early’ to deal with COVID-19, pushing out a range of cost control measures including six-month salary reductions for executive management and the board, reduced work hours and a freeze on marketing, travel, entertainment and discretionary costs.

ARN reported to be down 27% in trading for July, an improvement from 46% in the June quarter, as some clients return after lockdowns ease. August and September seem to be tracking the same as July. The company reports Q4 could show improvement.

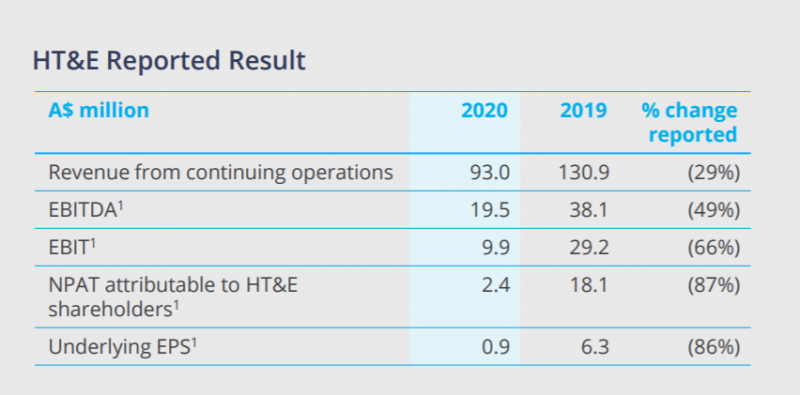

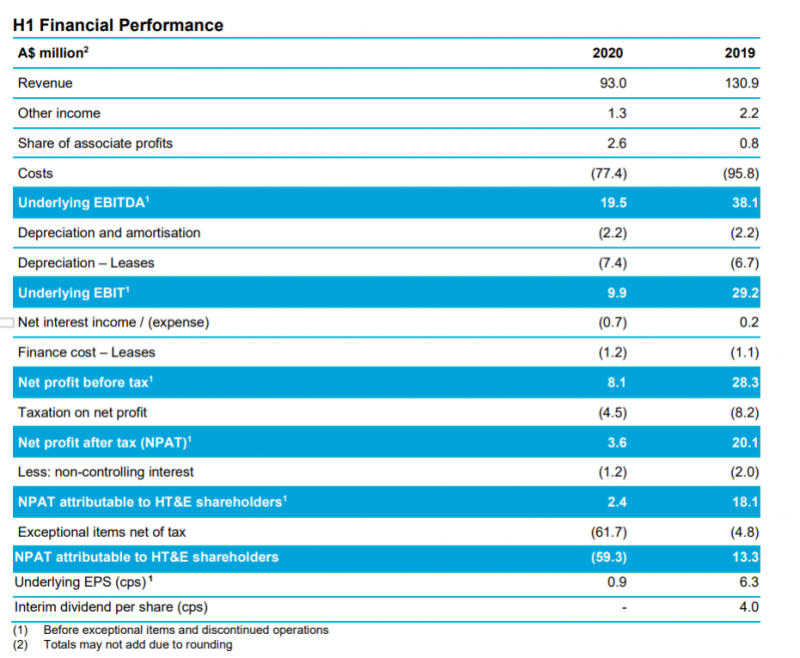

Revenue fell 29% for the period, to $93m, while EBITDA (earnings before interest, taxes, depreciation, and amortization) dropped 49% to $19.5m.

HT&E’s other assets, Hong Kong Outdoor and software company Soprano, saw mixed results – Hong Kong Outdoor reduced costs by 40% as outdoor revenues took a big hit during lockdowns, while Soprano reported its best operating performance in history, increasing revenue by 20%.

The company suspended its interim dividend to preserve cashflow. The business remains on track to deliver total temporary operating cost savings of between $11m-$14m this year, before the current JobKeeper subsidy benefit of around $9m.