Aussie ad spend grows 8.3% in November, halting 26-months of decline

Standard Media Index (SMI) has reported growth in the Australian media agency market, breaking a 26-month run of falling ad spend, the longest recorded advertising recession on record.

In the month of November ad spend experienced 8.3% year-on-year growth, as categories including TV and digital lead the way with double-digit rises.

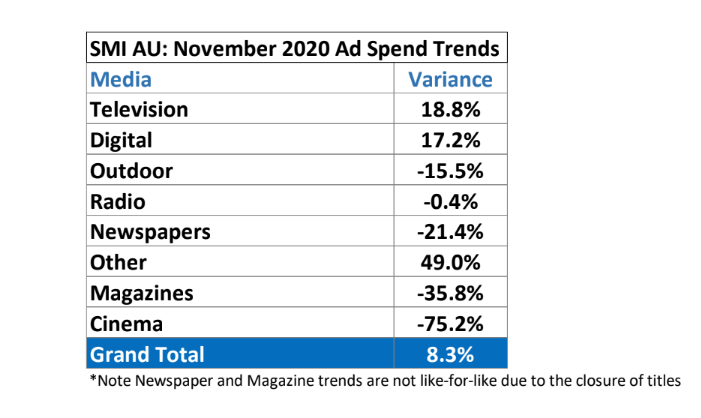

SMI November 2020 Ad Spend Trends

TV was the top-performing category, with ad spend up 18.8%, off the back of a strong October which was significantly boosted by NRL and AFL grand finals.

Collective bookings for the largest 10 product categories was up 20.7% for the month, as media investment significant increased throughout November. The Metro TV market outperformed the category overall, with 21.8% growth, hitting levels higher than seen in November, 2018.

SMI AUNZ managing director Jane Ractliffe said the category was seeing sustainable and organic demand for advertising.

“In October the TV results were buoyed by the move of the AFL and NRL finals series into that month due to COVID but in November the growth was purely due to a huge spike in demand for television advertising as retail, food and gambling advertisers all delivered double digit increases in TV ad spend.

“And while automotive brand ad spend remained lower overall this month, there is a sense that what was our market’s largest category may be about to finally accelerate its ad spending as it grew its TV bookings by 11.8% in November.”

Digital continued to deliver strong results, with 17.2% growth, off the back of a year where the category bucked downward trends in spend. Digital media has now reported four consecutive months of gains.

Radio also reported a much improved month, with spend down just minus 0.4%, while outdoor continues to recover with ad spend back minus 15.5%.

Magazine (35.8%) and newspaper (21.4%) categories were both down on year-on-year spend for November, but SMI noted that these trends cannot be considered like-for-like on the prior year due to closers of several titles.

Cinema is yet to see significant signs of a return to growth, but the sector showed slight improvement with bookings down minus 75.2% after they fell minus 91.3% in the month prior.

Ractliffe said the November figures were clear signs of a new phase of growth for the industry. “This level of higher November ad demand clearly highlights the start of a new growth phase for our market given the strength of the renewed confidence.

“And the strong support by the largest product categories shows the confidence is coming from a broad base of large advertisers that are recommitting to higher media investment.’’

Growth in media investment came in the retail (+18.2%) and food/produce/daily (+92%), categories. communications (+39.3%) and gambling (+54.6%) sectors also upped their spend.

“As is the case in November, it’s the largest categories delivering most of the strong financial year demand with the 10 largest categories collectively growing their ad spend over the past five months by 1.1%,” Ractliffe added.

“And among those categories most growth has come from food advertisers (+17.3%), retail (+8.9%) and toiletries/cosmetics (+20.3%) advertisers.”

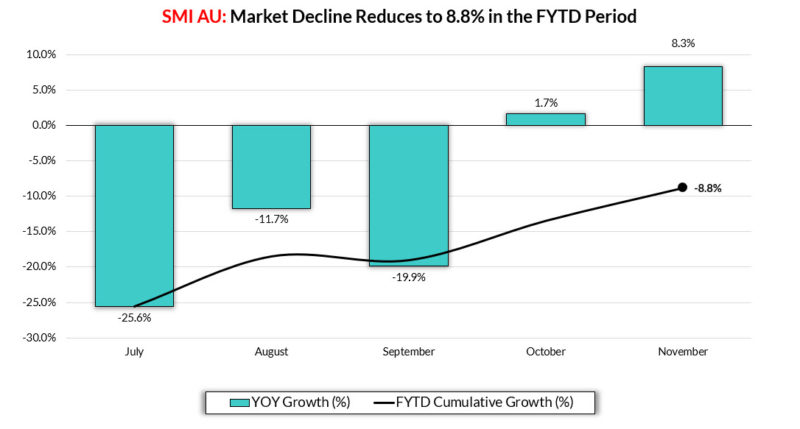

SMI was also able to revise its financial year-to-date bookings trend, now reporting a decline for the year to November of 8.8%.

SMI Financial Year To Date Bookings Trend

Linkedin

Linkedin