Trimantium GrowthOps trading halt lifted as ASX formally accepts request to delist

Trimantium GrowthOps’ (TGO) request to delist from the official list of the Australian Securities Exchange (ASX) has been accepted, meaning the company’s trading halt has been lifted and shares are now trading again.

The company is the parent of agencies including AJF Partnership and Khemistry, and had entered the trading halt on Tuesday, pending its request to delist.

Trimantium GrowthOps’ trading halt has officially been lifted

The ASX accepted the application from TGO, subject to approval from its board and shareholders, whose approval will be sought at the company’s annual general meeting on November 30.

TGO undertook an “extensive review of the business” during which it decided the ASX delisting was in the best interests of shareholders.

In an ASX announcement, the company’s main reasons for delisting were named as: limited trading of securities, share price volatility and valuation, the cost of administration, and the inability to raise capital through the issue of shares.

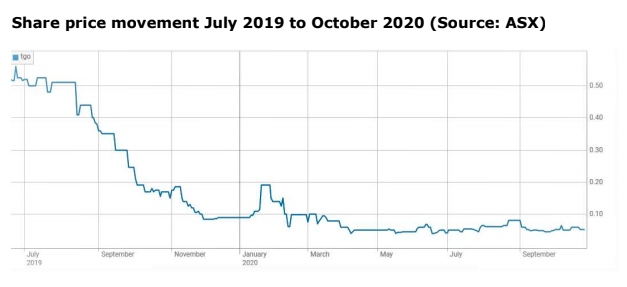

Specifically, the board believes that the company’s current and historical share price “does not appropriately reflect the underlying value of the Company” when compared with similar businesses.

TGO’s share price is currently trading at 5.3c. In March 2018, when it listed, shares were selling at $1.22.

The board additionally believes the current concentration and lack of liquidity is unlikely to improve in the foreseeable future, with the illiquidity of the security artificially increasing share price volatility.

“This excess volatility makes it ineffective and excessively costly for the Company to raise the necessary capital it needs,” the board said.

The company said it is “not benefiting from the advantages of listing”, despite facing the costs associated with listing, which it said are between $350,000 and $550,000 per year.

“Elimination of these costs could assist the Company’s operating cash requirements along with being better able to conserve cash flow and direct resources towards growing the business, particularly in a post-COVID-19 environment,” it said.

TGO added it is considering a number of initiatives to enable shareholders to sell their securities, including a minimum holding buy-back, and a share sale.

TGO founder founder Phillip Kingston stepped down from the company in February of this year, after Jason Polson exited the company in January following a three-month stint as Australian CEO.

In Thursday’s ASX announcement, the company said its key objects remain “delivering exceptional customer experiences for our clients; providing extraordinary opportunities and reward for our people; and continuing the turn-around in the Company’s financial performance to deliver long term value for shareholders.”

Linkedin

Linkedin