GroupM’s This Year, Next Year Global 2022 forecasts growth in ad revenues

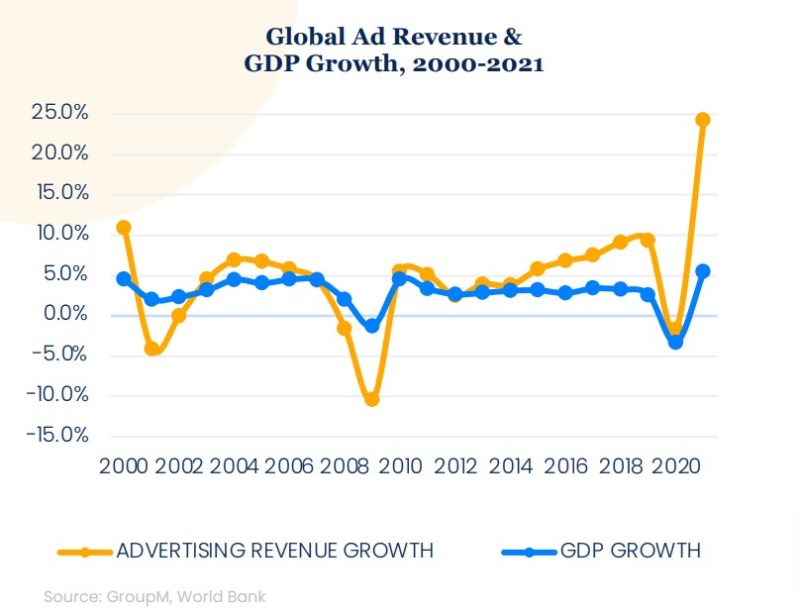

GroupM’s This Year, Next Year Global 2022 Mid-Year Ad Forecast published overnight shows significant growth in advertising revenue despite fears of an impending recession and ongoing geopolitical situations around the world.

Seb Rennie, GroupM Australia chief investment officer said: “As consumer habits have gradually returned to normality, so have media consumption behaviours. We came into the year with confidence and we still have a lot of confidence in the market for the year ahead and into 2023. In Australia, we are impacted by the ongoing global factors including the war in Ukraine and global supply issues, but we are also impacted by a change in local government, inflation, local energy dynamics and by our geographical proximity to some of the supply issues coming out of the APAC region.”