Growth slows for online ad spend, but one format is booming: IAB Australia

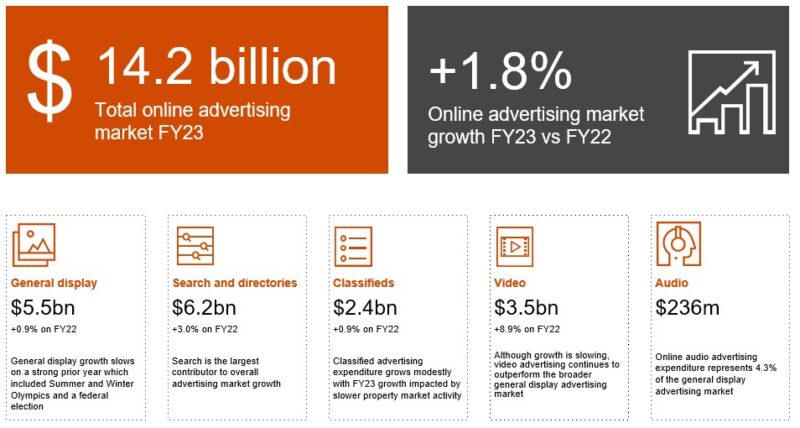

Growth in online advertising spending has slowed significantly in the Australian market, from a 22% year-on-year increase in the 2022 financial year to just 1.8% in FY23. However, podcast advertising boomed in the June quarter.

According to IAB Australia and PwC’s latest online advertising expenditure report, challenging economic conditions contributed to the slowdown in overall online ad spend, along with a strong comparative period, which included last year’s federal election and the Summer and Winter Olympics.