HT&E revenue falls 22%, but ARN’s recovery well underway

Here, There & Everywhere (HT&E) reported a fall in revenue across 2020, but its core radio operations via Australian Radio Network (ARN) performed ahead of the radio market in each quarter of the financial year ending 31 December 2020.

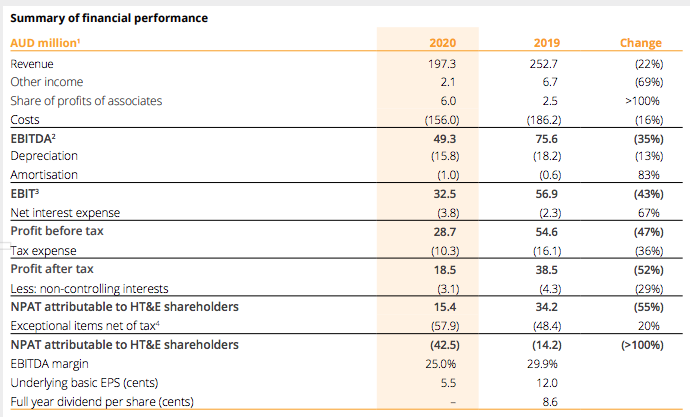

Revenue fell by 22% to $197.3 million, with underlying earnings before interest, tax, depreciation and amortisation EBITDA down 35% to $49.3 million.

HT&E chairman, Hamish McLennan, said he was pleased with the way the company got through a tough year. “HT&E navigated the period well and has maintained its strategic focus during the year, strengthening our core Australian radio operations, further investing in digital audio, as well as building further balance sheet strength, providing opportunity in a consolidating market.