REA Group posts growth in Q1 2022 financial results

News Corp-owned REA Group (REA), has posted its financial results for the three months ending 30 September 2021.

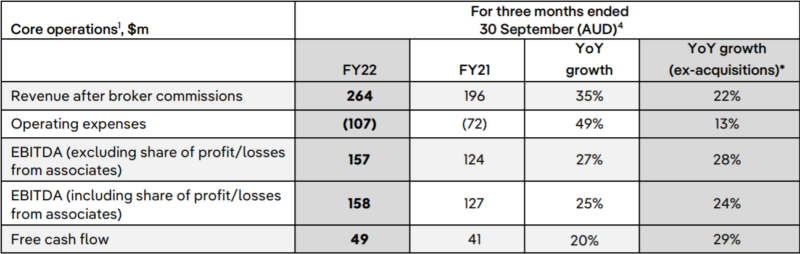

The figures include revenue of $264 million for the quarter, and EBITDA of $158 million, with revenue excluding acquisitions increasing 22% year-on-year.