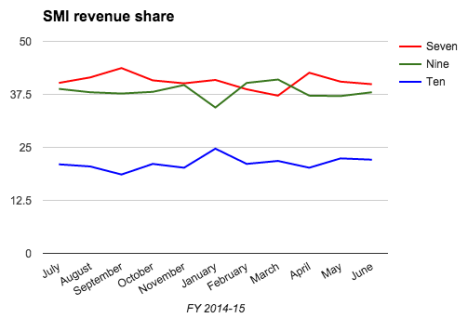

SMI: Ten lifts revenue share in 2014/15 while outdoor cements place above newspapers

Improved ratings have seen Network Ten post a major lift in revenue share in the final month of the financial year at the expense of both its rivals, lifting more than five per cent on last year, with a 23.1 per cent share (up from 18.0 per cent in last year).

Improved ratings have seen Network Ten post a major lift in revenue share in the final month of the financial year at the expense of both its rivals, lifting more than five per cent on last year, with a 23.1 per cent share (up from 18.0 per cent in last year).

According to the latest figures from Standard Media Index (SMI) Seven still leads they market with a 39.4 per cent share (down from 41.6 in June 2014) while Nine had a 37.4 per cent share (down from 40.4) in June, and Ten enjoyed a 23.1 per cent share, up from 18 per cent last June.

Overall ad spend by media agencies in Australia climbed to a record $7.8bn for the full financial year according to the new figures.

Does the ‘newspaper’ category include the reallocation of money to digital for traditional operators?

@Curious. No it doesn’t. It also excludes direct (approximately 60% of revenues) and classifieds.

Well I hate to think what the profit results are going to look like come late August. And with the property market on the skids we have to expect that Fairfax and News will be totally f%&*ked