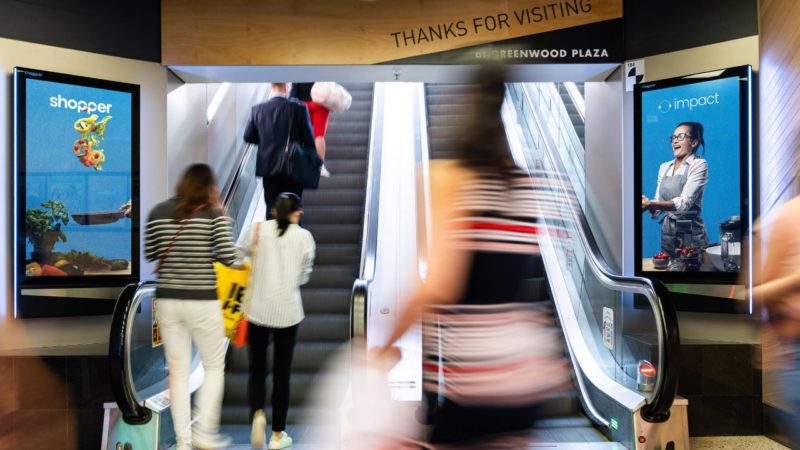

Australian consumer confidence hits 20-month high

The national mood has changed, with consumers looking towards major purchases, cooling inflation, and the possibility of interest rate cuts.

This is according to the Westpac-Melbourne Institute Consumer Sentiment index, which rose 6.2 per cent for the month of February, resulting in a 20-month peak.

Really ? I am in retail and speaking to others who have stores post holiday/Christmas slump is happening now