Australian tablet sales rise as higher end PC replacement devices enter the market

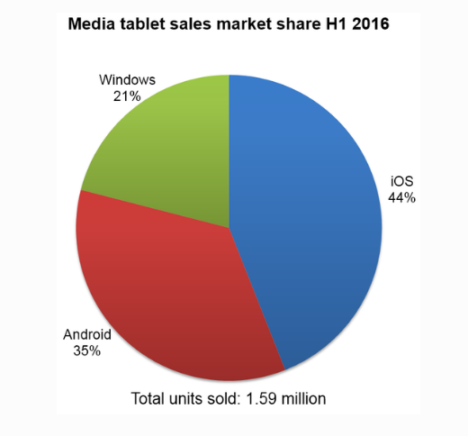

Telsyte market research results claim sales of tablet devices in Australia grew 4% year-on-year to 1.59 million units in the first half of 2016, and that Apple will retain its domination of tablet market for next two years, while key trends such as keyboard accessories for tablets will continue to rise.

The announcement:

Australian tablet sales bounce back as new higher end PC replacement devices enter the market