Cost-cutting and automation paying off: Isentia CEO

Isentia’s CEO Ed Harrison says reducing its labor costs and relying increasingly on artificial intelligence has helped the business get its balance sheet back on track and will enable it to focus on its core business.

Harrison was speaking to Mumbrella following the release of its financial results to the market last week, and said while the business he leads has faced significant financial hurdles in the past, it is not facing the same structural issues as ‘traditional’ media companies.

“We’re in a very different space. We’re not a traditional media company. There’s undoubtedly structural shifts for traditional media companies, but that’s not us. We run across all media channels including social media, so a huge part of our business is dealing with emerging social media platforms. So as media transforms and changes, that’s actually a larger opportunity for us. What we’re trying to do is make sense of that for clients, and there is more data, there is more noise, we’re really following all of the conversations occurring outside of their organisations. And as that dynamic plays out, there’s growing need for services like ours that make sense of all of that,” he told Mumbrella.

“Our business is not experiencing the structural [change] the same way as traditional media businesses. Obviously those macro, those economic factors, yes, that may well impact us. But we’re very different from those for want of a better word ‘traditional’ media companies.”

Harrison believes this, combined with reducing debt levels – down $10m over the year – and moving towards less labor costs has helped him sell Isentia’s message and products more effectively to the market.

“What we’ve been able to prove as well is the efficiency we can create in the business,” he said. “So we’ve invested in a lot of automation. For example, the print part of our business, so ingesting and determining relevance within print media, was only a short time ago 80% human and 20% machine. That’s now the other way around. So that process is largely automated, and we’re moving quickly to a world where that will be 100% automation.

“And we’re looking at other content or data pipelines for similar changes, so broadcast will follow a similar route. So that just means that our cost base is coming down, we’ve been able to reduce debt, so we’re in a good spot,” he said.

This, he said, is only going to continue throughout 2020.

“Increasingly AI and machine learning [is] allowing us to reduce the labor costs and also speed up, so what a lot of clients will see is increasing speed coming from our products as we automate more and more of those services,” he said.

As for improving the balance sheet by diversifying its revenue streams, Harrison said this was unlikely after the disastrous acquisition and disposal of King Content.

Isentia acquired content marketing business King Content in 2015 for $48m, but by 2017 had disposed of the brand, writing down $37.8m of its investment.

Instead, Harrison said, 202 is about focusing on Isentia’s core business.

“Look, at the moment the focus is very much on the core of our business,” he said. “We were quite deliberate about that when we put the strategy out a little over a year ago. And so that really remains our focus, is core media intelligence products and managed services. We think that that market is significant in size, with lots of opportunity for growth, particularly across Asia and south-east Asia.

“So if you look at south-east Asia, increasingly we’ve got growing sophistication of PR and comms disciplines in those markets, increasing appetite for needing to understand the data in this space, and a lot a lot of multinationals that are operating in the region looking for multinational partners. And we’re one of very few, or really the only significant APAC player. So all of those things play to our advantage.”

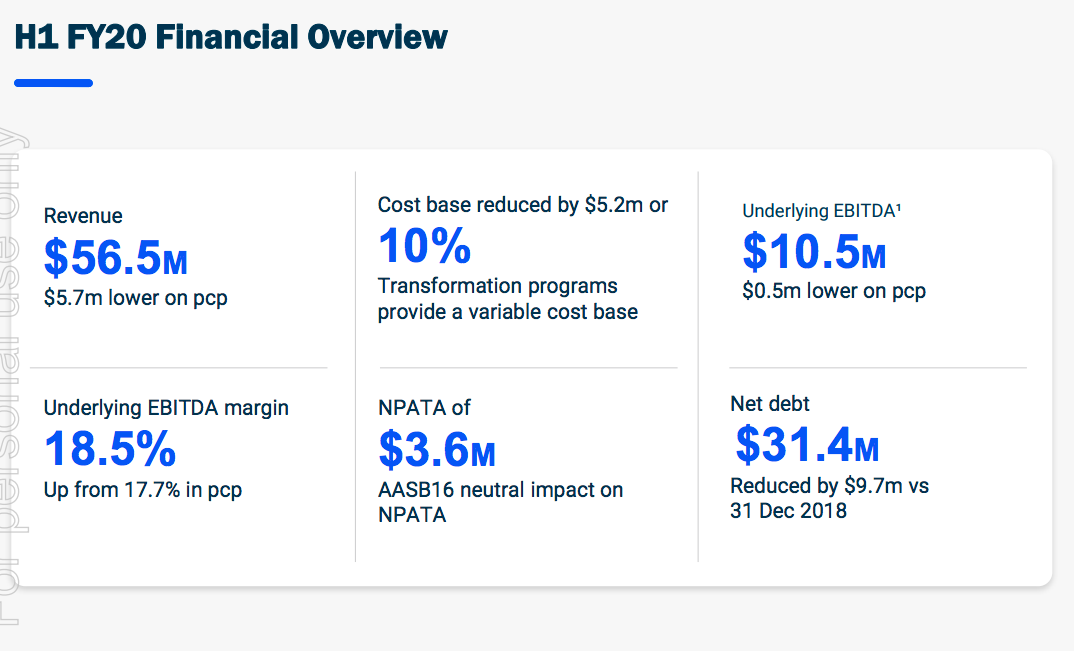

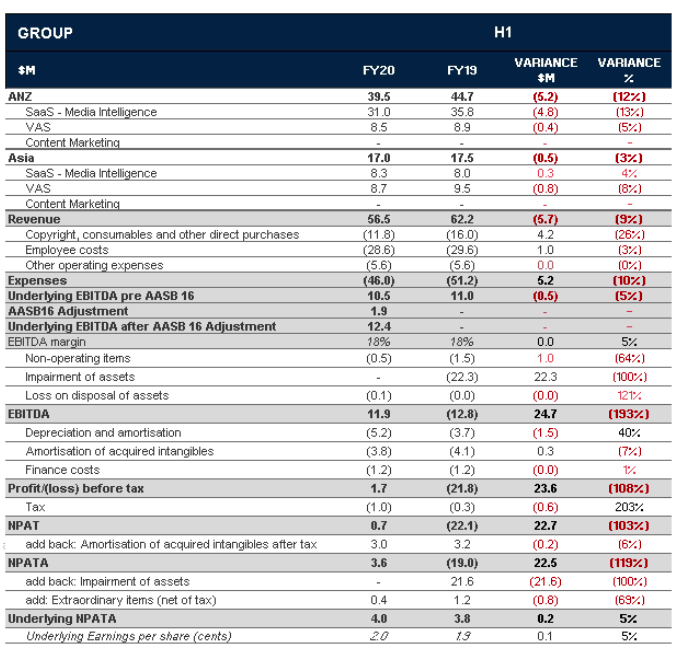

In its financial results for the half year to 31 December, 2019, revenue was down $5.7m, or 9%, on the prior corresponding period to $56.5m. Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) was also down $0.5m to $10.5m.

The group noted revenue was down in “due to a period of increased competitive tension [in ANZ], as well as ongoing challenges in North Asia.”

Isentia’s net profit after tax and amortisation (NPATA) was $3.6m. In the first half of the 2019 financial year, it recorded a loss of $19m due to the $22.3m write-down of intangible assets.

A lot of that automation was just shifting full-time jobs to Manila.