Debt piles up in latest half-year result for SCA; revenue flattening

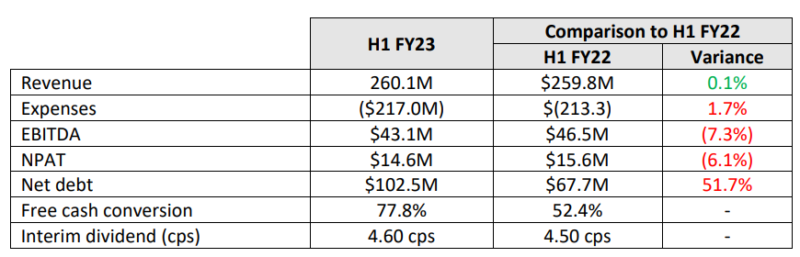

Southern Cross Media Group (SCA) has posted its earnings for the half year ended 31 December 2022. The revenue was up 0.1% year-on-year (YoY), but perhaps more glaringly, net debt was also up 51.7%.

The owner of LiSTNR, and radio networks Triple M and The Hit Network reported group revenue of $260.1 million in the first six months of FY23, compared to $259.8 million in the previous corresponding period.