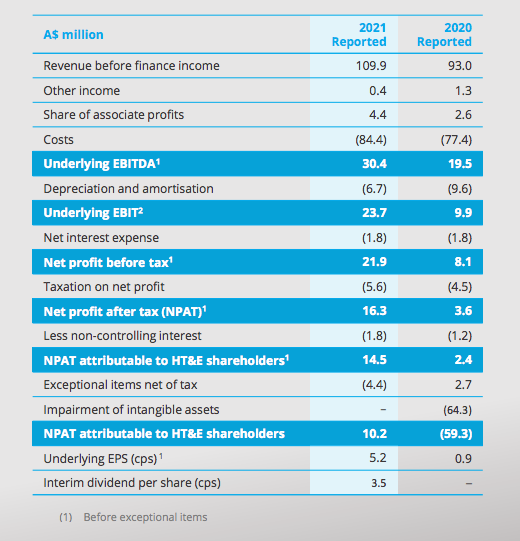

HT&E group revenue up 21% to $109.9m as ARN revenue jumps 22%

Here, There & Everywhere (HT&E) has continued its recovery in the first half of the 2021 calendar year, reporting a 21% increase in group revenue to reach $109.9 million.

Net profit after tax (NPAT) rose to $16.3 million, up from $3.6 million during the prior corresponding period, while underlying EBITDA rose 55% to $30.4 million.