‘Investment markets undervalue SCA’s business’: Sale rumours fly as SCA posts strong earnings

Southern Cross Austereo has posted strong full-year results during a twelve-month period in which it shed its television assets and recovered from a costly and fruitless takeover bid from its main competitor, ARN.

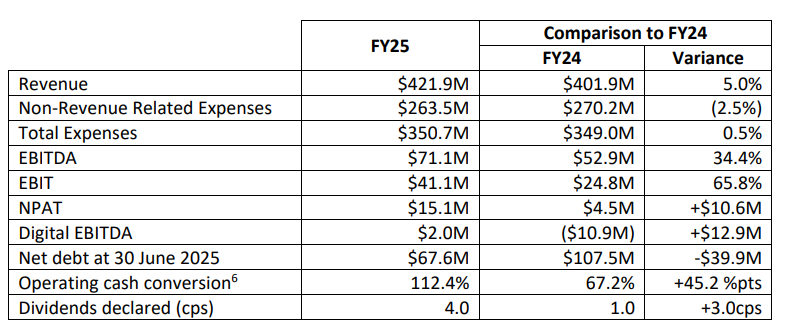

In terms of the company’s continuing operations — with its TV interests sold — revenue was up by 5% year-on-year to $421.9m. Underlying continuing operations EBITDA was $71.1m, up 34.4%, after excluding $11.8m in non-recurring restructuring costs.

On a statutory basis, which still includes TV up until its March/June divestment, group revenue was $491.3m, while reported EBITDA fell 21% year-on-year to $59.3m. The discontinued TV division contributed $2.8m profit in FY25, down from $6.5m in FY24, before being sold to Ten and Seven West Media.