Isentia posts $34m loss for CEO Ed Harrison’s first financial year

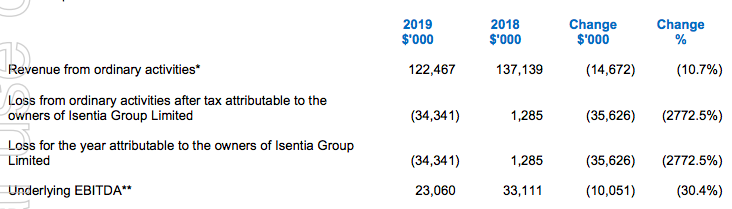

Media intelligence and data technology company Isentia has posted a $34.341m loss, a 2,772.5% decline from its profit of $1.285m for the 2018 financial year. The loss included a $40.959m impairment, $18.777m of which related to a write down in the value of brand names.

The challenging operating environment in Australia and New Zealand also resulted in an impairment charge of $18.975m relating to goodwill.

Revenue was also down 10.7% to $122.467m.

Why does this guy keep getting hired, from one failed company to the next?

[Edited under Mumbrella’s comment moderation policy]

Didn’t they also lose all their top management in Asia earlier this year? How can they bounce back from these departures if Asia is so important for growth?

One of the most efficient and remarkable management team on the earth. Why? Well because most of the new executives joined in H2 of FY19 and they managed to deliver a true miracle in short span of 4-5 months. Share prices must be going gangbusters. Wait what 32 cents. Ouch.