May sees a recovery in post-election ad spend, despite being the eighth consecutive month of decreased year-on-year growth

The media agency-funded ad market has clawed its way back from a pattern of notable decline, experiencing a strong turnaround in May after the federal election.

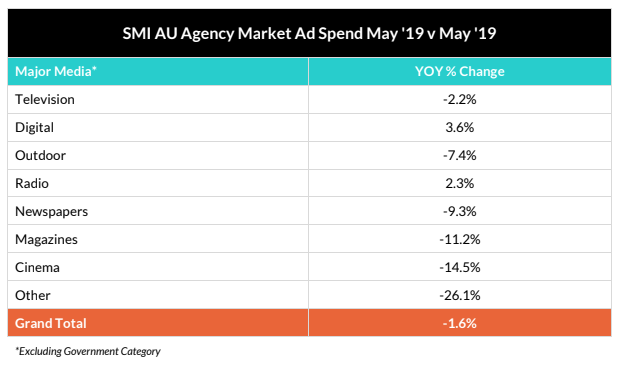

The above average recovery recorded by the Standard Media Index (SMI) saw the decline reduce to 1.6%, or $595.9m, and digital ad spend grow for the first time in four months, up 3.6%.