Netflix breaks stagnant revenue streak; ad-tier performs ‘above initial expectations’

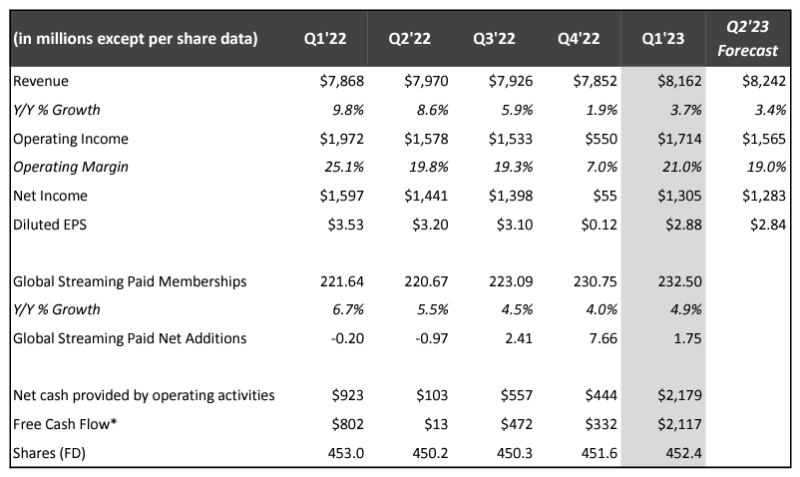

Streaming giant Netflix has continued its growth trajectory in subscription, as the business reported 232.5 million paid memberships in Q1 2023, an increase of 4.9% year-on-year (YoY).

However, different from the previous quarter, its revenue also increased to US$8.16 billion (A$12.15 billion) in the three months ended 31 March – a 3.7% increase YoY.