New study finds loyalty programs don’t necessarily breed customer loyalty

Bunnings PowerPass has the loyalty of the masses, according to Honeycomb's new study

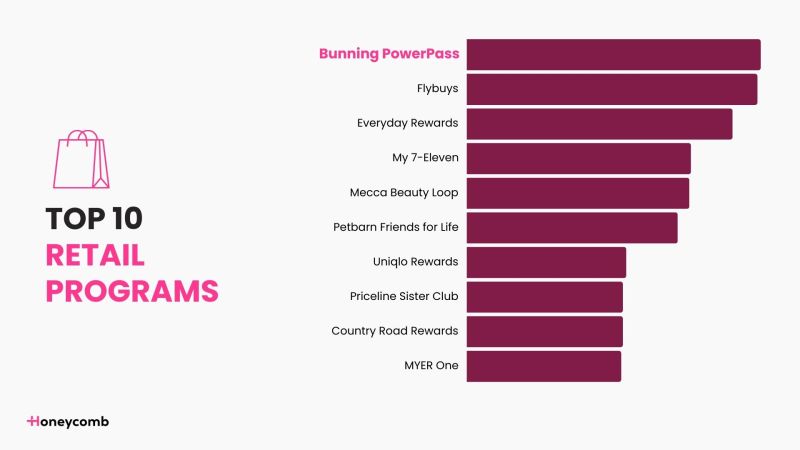

Bunnings is leading the pack when it comes to eliciting customer loyalty from its loyalty program, according to new research from Honeycomb Strategy, which shows shoppers are increasingly expecting more from a business in exchange for signing up to such programs.

‘The Science of Loyalty: From Situationship to Relationship’ claims to be Australia’s largest study into loyalty program success.

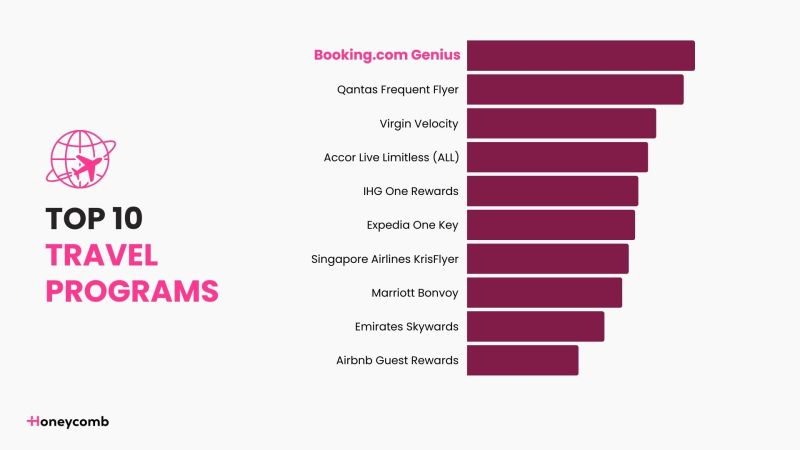

Honeycomb Strategy studied 52 of the country’s biggest loyalty programs across a number of categories, including retail, travel, finance, banking, and telecommunications. It looked at membership rates, customer engagement, and impact on overall spending, three key metrics that went into a combined score.

Over 2000 Australian consumers were interviewed for the study.

The best-performing programs are the ones that work in concert with regular shopping habits.

Bunnings Powerpass program was the top-performing program, followed by Coles Plus, Wesfarmers’ One Pass, Woolworths Delivery Unlimited, and Costco membership.

Aside from Bunnings, all of these loyalty programs require payment to join, in exchange for a number of perks, including streaming subscriptions, free delivery or shipping, or — in the case of Costco — the right to enter one of their stores and buy a 10kg tub of cheese puffs.

Flybuys is the country’s second top-performing free loyalty program, while other favourites (free or otherwise) include American Express Membership Rewards, eBay Plus, Telstra Plus, and Uber One.

The best performing programs saw more than a third of users saying they exclusively use that brand due to the benefits on offer.

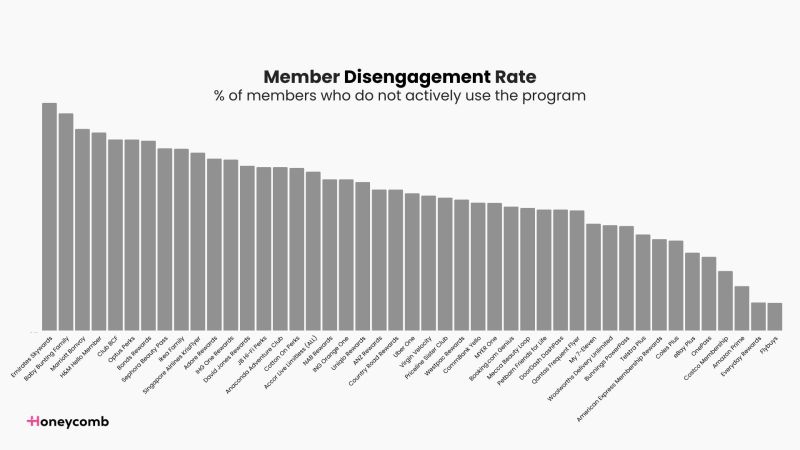

Interestingly, the study found no correlation between the number or type of benefits offered and the success of a program – suggesting there’s no easy catch-all approach. It also found that there is a limit to how many programs the average consumer tends to engage with. While consumers each have an average of eight loyalty programs, they only actively engage with five, meaning that competition is fierce. Prompting an initial sign-up isn’t enough to assure customer loyalty.

Another trend is the rise of paid loyalty programs. The buy-in aspect seems to be shifting the expectations of the overall loyalty program landscape, with consumers now expecting that the businesses are “overdelivering on the value exchange”, as the report puts it.

Honeycomb found that 72% of Millennials and 65% of Gen Z’s now subscribe to paid programs, with Wesfarmers’ One Pass the country’s top paid loyalty program, followed by Costco Membership — which is required to shop in their bulk stores — and Coles Plus, eBay Plus, and Woolworths Delivery Unlimited – all of which offer free delivery or shipping on items.

“Seven in 10 consumers expect immediate benefits from their loyalty program, while 63% quickly lose interest if the program doesn’t give them something new or valuable,” said Renata Freund, Honeycomb Strategy’s founder.

“While consumers join loyalty programs to receive immediate benefits, only a handful of programs make it into active mental rotation, with the rest falling into the noise. Brands are not just competing on benefits, they are competing for attention, and attention is scarce.”

The loyalty programs with the highest attrition rates are the more specialised or high-end programs, with Emirates Skywards, Baby Bunting Family, Marriott Bonvoy, H&M Hello Member, and Club BCF leading the list for fairweather shoppers.

Conversely, Flybuys, which has garnered three decades of loyalty since launching in 1994, has the smallest attrition rate, followed by Woolworths’ Everyday Rewards program, which launched in 2007. Both these programs are simple to use, offer a simple points system, and have decades of habitual behaviour.

Of course, this wouldn’t be a consumer trend study without a handful of behavioural science takeaways. The report highlights five key motives that drive customers to sign up and stay loyal.

Loss aversions theory is number one. “The top programs are creating a sense of ownership and potential loss by over-delivering on the value exchange.” Members stay engaged to keep the value they’ve already earned.

Mental accounting also plays a major role. Customers can mentally partition ‘normal’ day-to-day spending from spending that uses benefits gained through engagement with a loyalty program. “This makes the benefits feel more valuable and satisfying, motivating continued engagement,” the report notes.

‘Social identity theory’ posits that the best programs succeed by creating a group that customers want to feel a part of – the classic example being the American Express Black Card – an invite-only card the US bank offers, which is seen as a sign of prestige or wealth.

The reciprocity effect works by “framing rewards as genuine gifts”, thereby generating goodwill for the brand. This motivates customers to, in return, reward the business for these ‘gifts’ with future business.

Finally, there’s cognitive ease. If you remove any friction, and remove the conscious effort required to engage in the program, people are more likely to use the program.

“For most brands that challenge isn’t providing the right mix, or more or meaningful benefits, it’s delivering a loyalty program that addresses the other key areas that are commonly overlooked – frictionless engagement and triggers to engage,” Freund said.

“The brands that are doing this well are seeing loyalty translate into tangible impact on spend, not just membership vanity rates.

“The truth is that a large portion of Australia’s loyalty programs are great at driving the initial sign-up with a motivating benefit, but very few are translating that into ongoing engagement that ladders up to meaningful ROI.”