News Corp posts strong performance despite Australian slow leak

News Corp’s global business has posted strong full year financials — with a 2% rise in full-year revenues and a 14% increase in EBITDA (earnings before interest, tax, depreciation and amortisation) — despite declining revenue in its Australian operations.

One of the weaker performers in the News Corp portfolio was its News Media division, which globally saw its full-year revenues decline by US$100 million (AU$155m), or 4%. Within this, advertising revenues decreased by $39 million ($60m), or 5%, primarily due to lower print advertising revenues at News Corp Australia and lower digital advertising revenues at News UK.

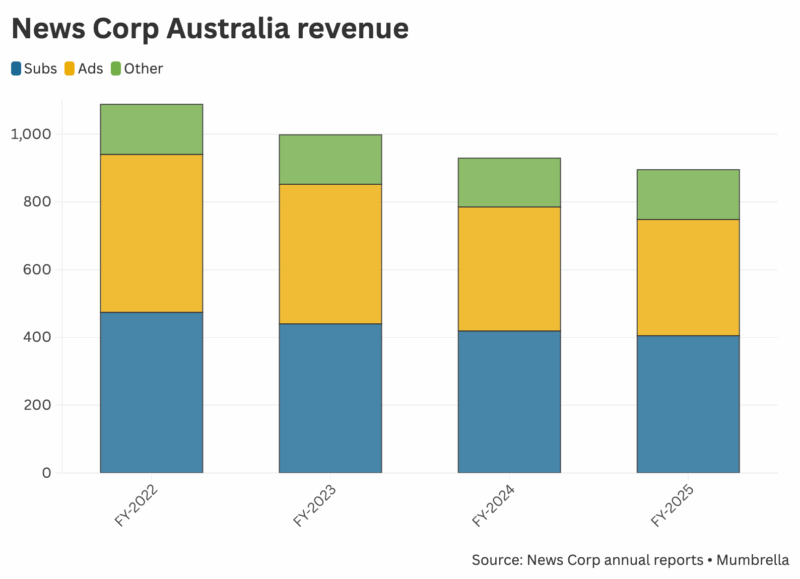

The Australian business, which is split out into “Advertising”, “Subscription and circulation” and “Other” lines, saw total revenue go 2% backwards year-on-year. Advertising revenue was down 5%. Stacking the numbers for the past four financial years shows a clear downward trend (see graph). Because News Corp does not break out EBITDA or net income numbers for Australia, it is not possible to judge Australian cost management and profitability from these accounts.