News Corp Q1 results for fiscal 2023: revenue dips 1%

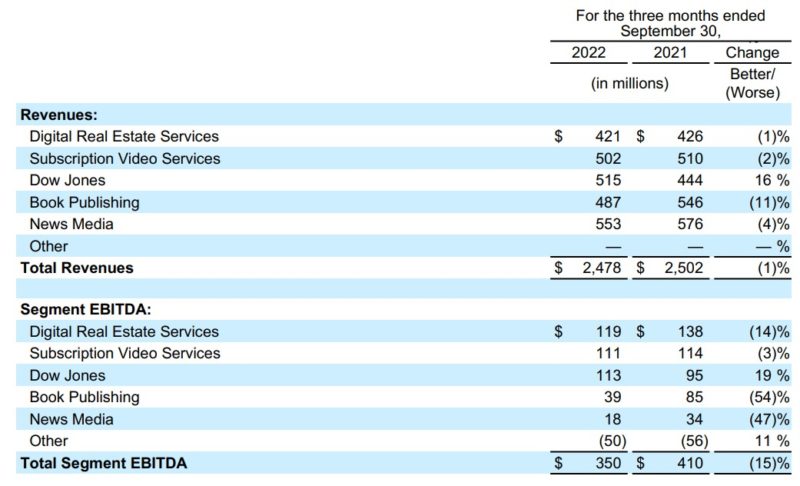

News Corporation today reported fiscal 2023 first quarter total revenues of $2.48 billion (A$3.81 billion), a 1% decrease compared to $2.5 billion (AU$3.84 billion) in the prior year period.

The decline was reported as primarily due to a $153 million (A$235 million), or 6%, negative impact from foreign currency fluctuations and lower revenues at the Book Publishing segment due to lower physical book sales from Amazon, partially offset by higher Dow Jones segment revenues, which included the acquisitions of OPIS and Chemical Market Analytics. Adjusted Revenues increased 3%.