Nine reports a 9% drop in profits, points to growth in digital and $100m of cost removal

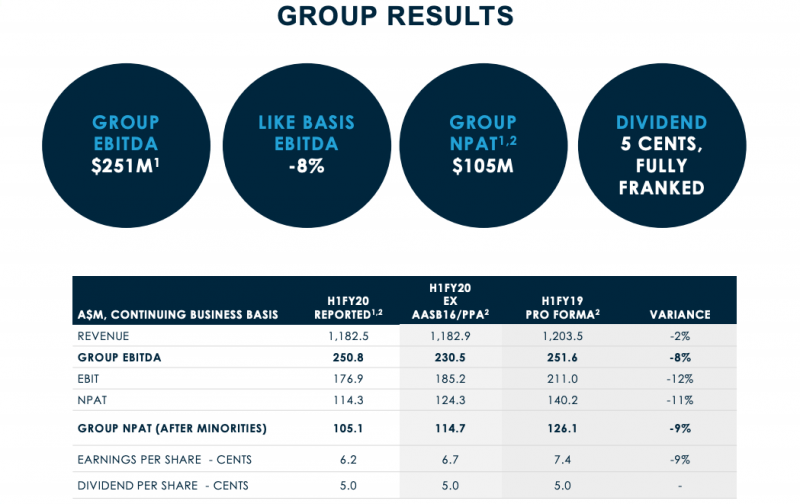

Media giant Nine has reported a 9% drop in profits for the first half of the 2020 financial year and an 8% drop in earnings before interest, tax, depreciation, and amortisation (EBITDA) as it faces “cyclical headwinds” across its traditional media assets.

Revenue across the business was $1.182bn, down 2% from the same half in 2019, and group EBITDA dropped to $250.8m. Net profit after tax was $105.1m.

“the business had not capitalised on its ratings success” – are there even sponsors for MAFS? Hilarious if not.

How are Car Advice and Pedestrian going? Didn’t see any mention

They would be in 9 Digital Publishing – which was down 10%.

Nine is and has been bloated for ages. Costs vs Revenue is still way out of control. Too many department heads. Environment becoming too cluttered…

The poor results stemming from the “Macquarie Media specific issues” were not only “not particularly surprising”, they were entirely predictable, and indeed were predicted. The Nine takeover first put a question mark over the whole Macquarie network. Instead of reassuring listeners, the new owners tinkered with the schedule, dropped Chris Smith in favour of the light and fluffy Deborah Knight, and even let it be known that Alan Jones was under threat. Dearie me, it could have been handled worse, but not by much.