Omnicom Group posts ‘stronger than expected’ organic growth in Q4, ending 2022 on a high

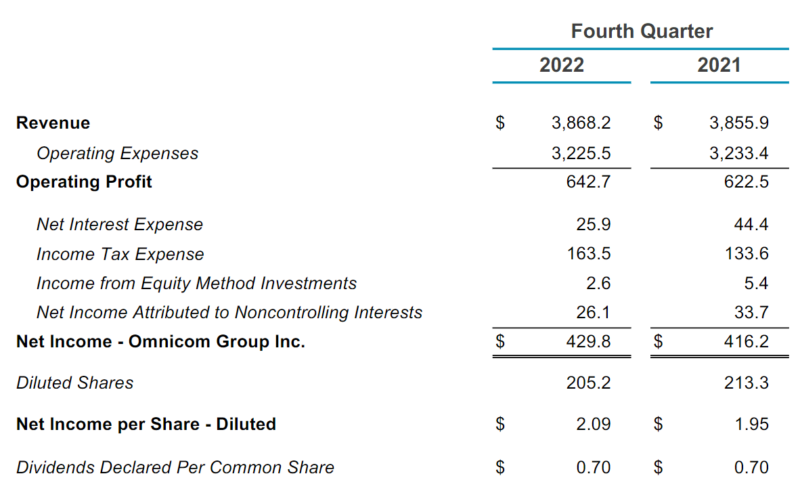

Omnicom Group finished 2022 “stronger than we expected”, according to chairman and CEO, John Wren, after it posted revenue of US$3.87 billion (A$5.57 billion) for Q4 and organic revenue growth of 7.2% for the quarter.

The company reported an operating profit of US$642.7 million (A$924.2 million), an increase on 2021, with an operating profit margin of 16.6%.

*Figures reported in US$ millions