Ooh Media’s profit slides over 90% in ‘challenging’ media market

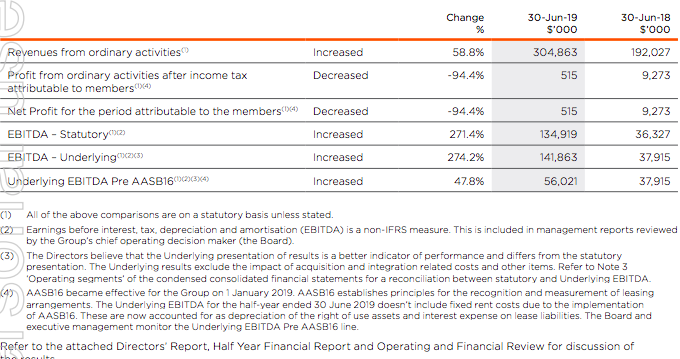

Outdoor advertising giant Ooh Media – which also owns publisher Junkee and last year bought street furniture business Adshel – has revealed its profit slid 94.4% for the six months to 30 June, 2019. Profit was down to $515,000 for the six months to 30 June, 2019, from the $9.273m it posted the year before.

The directors of the company said its underlying results better reflected the company’s performance. Ooh Media’s underlying net profit after tax (NPAT) was $9.0m, down 24% on the year prior.

The underlying results exclude some costs and non-operating items, such as those related to the acquisition of Adshel.