RXP Group reports 26.2% growth in FY19, but will close underperforming Hong Kong operation

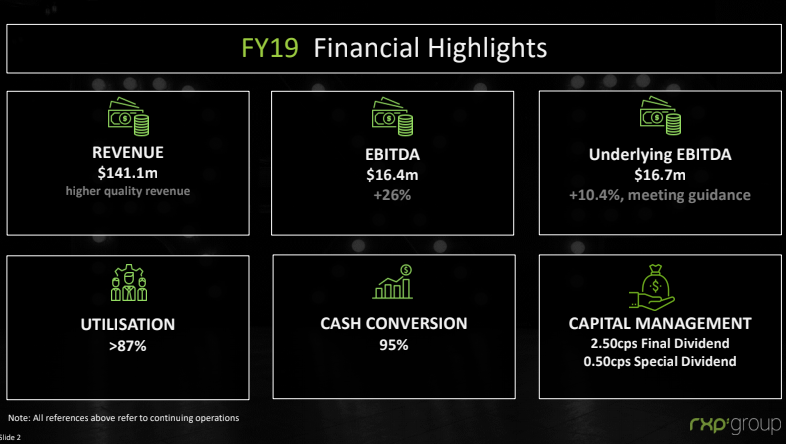

RXP Group – the digital services consultancy which owns creative agency The Works – has reported a 26.2% jump in earnings before interest, tax, depreciation and amortisation (EBITDA) to $16.4m in FY19, following on from 2018’s $13m result. However, it will be closing its Hong Kong operations due to underperformance, with a sale option in progress.

In addition, the results revealed that RXP didn’t have to pay a final earn-out to the founders of The Works – likely due to the loss of the Optus account.