A tax on social media companies is the cost-of-living solution we need

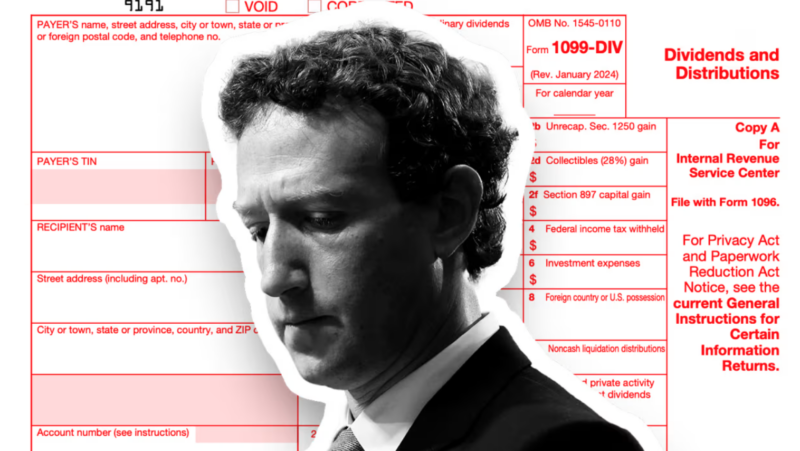

The Federal Government is considering a new tax on overseas media giants as a sneaky new way to force Meta and Google to continue funding Australian journalism.

A Labor-led ‘Joint Select Committee on Social Media and Australian Society’ this week acknowledged that the News Media Bargaining Code, introduced by the Coalition in 2021, has “fundamental problems” – namely, it didn’t work – and instead recommended a new levy on large digital platform, which would then be distributed to the media companies.

The News Media Bargaining Code ostensibly gives the government powers to ‘designate’ tech companies and force them to pay for news content shared on their platforms, should they choose not to strike such deals themselves.

So you want essentially us in the end to bankroll stubborn old iron media refusal to evolve? Fantastic. Let’s just throw our money at propping up mediocrity and clinging to a broken outdated model. Nothing says ‘progress’ like anotheeeeeer tax to keep the dinosaur aka old iron media alive.

This isn’t the flex you think it is.

Yes Sean, attention-seeking influencers and conspiracy theories is a great replacement for public interest journalism.

You can celebrate with your viral dance videos when we can’t agree on a single fact since everything will be subjective and whatever people disagree on will be considered ‘fake news’.

Not a world I want to be part of.