Producer Offset: clearing the confusion

Kylie Parker has seen many productions become tangled in the bureaucracy between professional services firms, Government bodies and the Taxation Office. It’s time to clear the confusion.

Kylie Parker has seen many productions become tangled in the bureaucracy between professional services firms, Government bodies and the Taxation Office. It’s time to clear the confusion.

At the recent SPAA Conference, the talk around the pool centred around having an idea and needing to obtain just a bit more finance before starting production, and discussion about whether or not it is better to cash flow the tax rebate using money from financial institutions, state film bodies or private investors.

The statistics from Screen Australia reveal that since its inception in July 2007 to 31 December 2008, 192 production companies have been issued with provisional certificates and 15 final certificates have been issued with a total determined QAPE of $28,144,329. The proportionately low number of final certificates issued suggests that producers (and some financiers) may still be finding it difficult to effectively convert the offset into real finance.

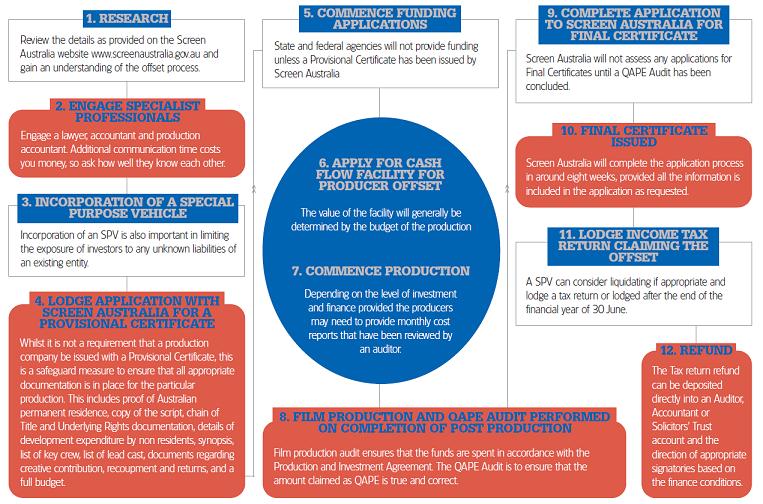

So what is the process, and how can a Producer whose background is not in finance be certain they are not lining the pockets of financiers charging high rates of compounding interest, or accountants and lawyers creating monopolies around their knowledge?

(Please click on the image to view a larger version)