ANZ crisis: ASIC has learned the art of communicating

This week ANZ was fined a record $240m for a range of wrongdoings affecting 65,000 customers and costing the Federal government millions. ASIC chair Joe Longo maintains the bank’s behaviour was “very grubby and very serious”. “It was unconscionable conduct … unacceptable,” he told The Australian. “It’s probably one of the most serious things a bank has done in Australia in years.” Communications expert Peter Wilkinson picks apart the crisis.

It’s worth watching and learning from ANZ’s bad few days. Sometimes big organisations get so tied up in complexity that they overlook the basics. Sometimes, too, fear drives decision-making.

Here are two winning communication principles in a crisis.

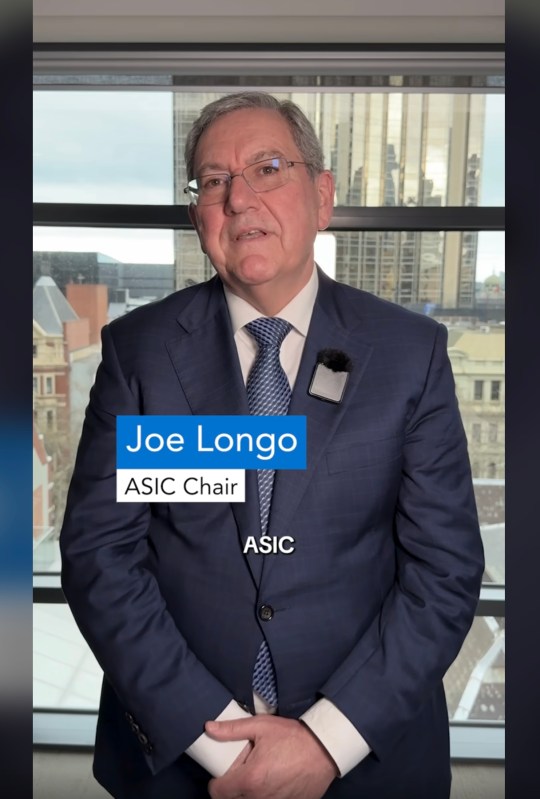

First: Go early and strong. If you wait, someone else will control the narrative. That appears to be what’s happened at the start of this week. ASIC chair Joe Longo has all the strong quotes, and is in control of the narrative. He monopolised the media space, in the media through the day, on 7.30 last night, and his video piece on Linkedin is well done.

Joe Longo’s ‘down the barrel’ video on Linkedin

Can someone tell me if a bank like ANZ has millions of customer how are they supposed to know if one of their customers dies? If a single person has banked with ANZ for decades and they pass away how does the bank know they no longer exist?