APN News and Media sees half year profits drop with regional publishing hardest hit

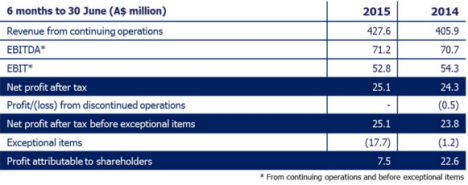

APN News and Media has has posted a net profit of just $7.5m for the six months ended June 30, down 67 per cent from $22.6m last year.

APN News and Media has has posted a net profit of just $7.5m for the six months ended June 30, down 67 per cent from $22.6m last year.

The company, which owns the Australian Radio Network (ARN) and various newspaper and advertising holdings, reported a net profit after tax before exceptional items of $25.1m, up three per cent year on year.

The company said the loss of its bus body contract in Hong Kong, which required a restructure of the business and 50 per cent of employees leaving at the end of June, was the most significant item in the $17.7m hit to the bottom line. The company said redundancies in both publishing divisions also contributed.

APN posted an earnings before interest, tax, depreciations and amortisation (EBITDA) of $71.2m, up one per cent when compared to the same six months ended June 30 last year.

APN CEO Ciaran Davis, who commences in the role today after being appointed in June, said in a statement: “APN’s 2015 first half results reflect a soft advertising market in Q2 and a company in an important transition phase. APN continues to generate strong cash flows and we have good balance sheet flexibility to invest in further growth opportunities.”

Revenue from continuing operations was up five per cent to $427.6m.

The company attributed the strong revenue performance to the growth in ARN following last year’s audience gains and the acquisitions of Perth’s 96FM in January this year.

ARN grew its revenues 29 per cent due to investments made in Perth, Melbourne and Drive – where it has bought Dave Hughes and KAte Langbroek back for a new national show on KiisFM. The radio company saw its EBITDA grow by 26 per cent while costs grew 30 per cent year on year due in part to the 96FM acquisition.

“The Australian Radio Network (ARN) continues to have strong market leading positions in key metro markets across Sydney, Adelaide and Brisbane, and there are very encouraging signs from the launch of Kiis 101.1 in Melbourne and the investment in Perth’s 96FM, which is integrating well into the Kiis network,” Davis said in a statement.

“A number of revenue growth strategies are in place to maintain ARN’s positive momentum.”

The company’s Australian Regional Media, which today has announced its new digital subscription packages with News Corp and Foxtel properties, has seen its EBITDA slide by 22 per cent, with softer market conditions in quarter two affecting the company’s overall revenue performance.

ARM’s revenues were down five per cent year on year and local advertising revenues were down by two per cent on the year prior while cover price increases helped slow circulation revenue decline.

Digital revenues posted a 40 per cent growth year on year on a like for like basis, with mobile now making up over half of ARM’s digital audience consumption. Print audiences remained steady.

Davis said in a statement: “ARM’s revenues reflect a soft Q2. The business continues to focus on costs with $10m of annualised cost saving initiatives being implemented across 2015 and 2016. The business has again seen record audience growth, driven by digital and mobile consumption and has a number of initiatives in place to monetise this growth, including the launch of digital subscriptions and new mobile and tablet apps.”

Outdoor advertising business, Adshel, which is part owned by iHeartMedia, saw its revenue grow by eight per cent to $72.2m while EBITDA was up six per cent to $14.5m.

“Adshel is continuing to digitise its assets to drive revenue and market share growth,” said Davis in a statement.

“In addition, it is focused on delivering data solutions for advertisers through the launch and subsequent expansion of its beacons network in Australia and New Zealand.”

The company’s New Zealand Operations NZME posted revenues of NZ$214.9m, down by one per cent while EBITDA was down 13 per cent.

NZME Publishing posted a revenue of NZ$144.9m, up two per cent year on year while NZME Radio revenue were down two per cent year on year to NZ$60.3m.

“NZME revenues are tracking in line with the market forecast released in November 2014 and good strategic and operational progress has been made with the integration of the three New Zealand businesses in what has been a challenging advertising market and generally weak economy,” said Davis in a statement.

APN’s Hong Kong based outdoor advertising business experienced a weak start to the year due to the flow on effects from the Occupy Central protests in Q4 of last years.

The transition out of the bus body contract also started to impact bookings from May.

Revenue for the company decreased 12 per cent and EBITDA declined substantially to HK$0.1m.