Foxtel revenues fall but Kayo shows promising early subscriber numbers

Price increases have hurt Foxtel subscriber revenues, but its new sports streaming service Kayo has delivered 100,000 paying customers, News Corp has revealed.

According to the company’s quarterly results, Kayo – which launched in November – has 115,000 subscribers, of whom 100,000 are paying.

Thanks to the launch of Kayo, Foxtel subscribers of all types including streaming and broadcast television rose to 2.9m, slightly up on the year before. However, the average revenue per subscriber fell by 3% to $78 per customer.

Churn – the number of users giving up their subscriptions – rose from 14.5% to 15.6%

Foxtel’s costs also increased, thanks to more costs for cricket and NRL and a marketing campaign for Kayo. Last April Foxtel teamed up with Seven for a billion dollar bid for the Australian cricket rights which saw the broadcaster launch a new Fox Cricket channel.

Direct comparison’s on News Corp’s performance compared to the previous year are difficult because the company has only recently started to include Foxtel’s numbers since it increased its stake to two-thirds over Telstra’s one-third. It was previously a joint venture.

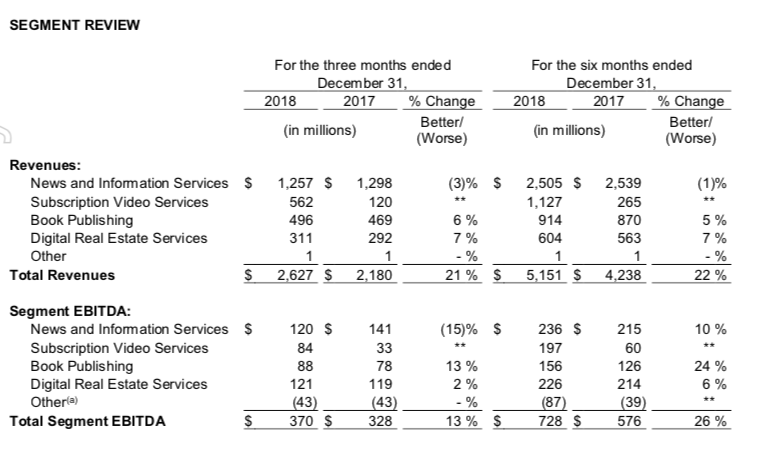

The new accounting approach saw News Corp’s reported global revenue jump by 21% to $US2.63bn. This was also assisted by improved numbers in the company’s real estate and book publishing operations.

News CEO Robert Thomson said the group’s results highlighted “the power of premium content and authenticated audiences in a fact-challenged world.”

On a like-for-like basis, the company recorded a 13% jump in earnings before interest, taxation, interest, depreciation and amortisation (EBITDA) to $370m for the quarter.

News Corp Australia itself recorded a revenue fall of 5%, however the company’s local mastheads reported digital subscribers had increased to 460,300 compared to 389,600 in the year before.

A bright spot for News in Australia was 62% owned REA Group which increased revenues 6% to US$189 million from $178 million in the prior year on the back of increased local residential earnings.

Commenting on the results, News’ chief executive Robert Thomson struck an encouraging note but warned the group was still battling a dysfunctional digital advertising market.

“News Corp has reported increased profitability and revenue growth during the first half of Fiscal 2019, highlighting the power of premium content and authenticated audiences in a fact-challenged world that craves credibility,” said Thomson.

“For the second quarter, the Company saw 21% revenue growth and a 13% rise in profitability, reflecting the consolidation of Foxtel and a healthy expansion of revenues in the Book Publishing and Digital Real Estate Services segments.

“At News and Information Services, we saw a continuation of positive trends in paid digital subscriptions, including accelerating gains at The Wall Street Journal, and stronger digital advertising revenues in both the U.S. and Australia.

“Although our teams have been diligent in pursuing revenue opportunities, the digital platforms, which arbitrage algorithmic ambiguity, remain dysfunctional. It is clear that there has been a regulatory awakening and the time has come for a regulatory reckoning.

“At our Digital Real Estate Services segment, despite sluggishness in the U.S. property market, Move delivered another quarter of double-digit revenue growth, driven by product innovation at realtor.com and the acquisition of Opcity, a strategically important asset that will provide higher quality, value-added leads for brokers.

“Within our Subscription Video Services segment, this quarter we launched Kayo Sports, a sports-only OTT product, to positive reviews, and we look forward, with confidence, to the peak selling season for the most popular winter sports in Australia.

“Finally, HarperCollins had another outstanding quarter, benefiting from best-in-class content and the burgeoning of digital audio.”