GrowthOps reveals Holden’s exit from Australia and COVID-19 have taken their toll on its bottom line

GrowthOps – the ASX-listed roll-up of agencies including AJF and Khemistry – has issued a note to the ASX ahead of its financial results later this month, noting the impact of reduced revenue.

The company said the downturn was due to both COVID-19 and Holden’s exit from Australia. Holden had been a key client of GrowthOps agency AJF.

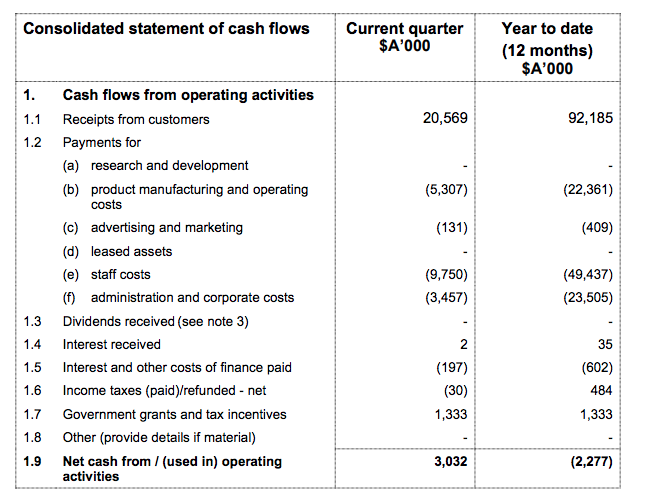

The ASX update said receipts from customers for the quarter were $20.6m, down $439,000 on the prior quarter. For the year to 30 June, 2020, the figure was $92.185m.

Just Holden…come on TGO, we all know that a heap more of clients have left in droves!

All that kerfuffle to end up just being a far less successful version of AJF.

There needs to be a two-year cooldown period for any company that expresses the desire to list in the ASX. Prove you can make money first, instead of using the ASX as a way to bail out all the other businesses you’ve run into the ground.

those shareholders…buys something at $1.30 and look at it now…I would have to admit GO were pretty “lucky” that a pandemic hit. It bought them a bit more time from a survival perspective…would be interesting to see when the government grants run out and what plan the company has in place to pay off that Westpac loan…

Unsure as to why Mumbrella has been taking it so easy on TGO ever since the interview with Phil. Previously found their articles very informative with more information than people could get from working in the company. Also entertaining.

Holden and COVID are not the problem – this business has been doomed for some time.