Kerry Stokes says goodbye to his shareholders as SWM accelerates its cuts

Today’s annual general meeting of Seven West Media was the last with Kerry Stokes as chair. As he said his goodbyes, this is what the market learned.

Stokes: Will soon leave the Seven board

Although he remains in the chair for another three months, Kerry Stokes farewelled shareholders today.

At Seven West Media’s last annual general meeting before its merger with Southern Cross Austereo, Stokes reminded his audience that although he will move on in February, his son Ryan will remain on the new board, and his family’s indirect stake in the business will keep the 85-year-old interested.

Stokes owns just under 51% of Seven Group Holdings, which in turn owns just over 40% of Seven West Media. After the merger, that number will fall to about 20%.

On the way out of the door, there was a mild surprise: Stokes took a whack at Seven’s long-term sports partner, the AFL, which was, he implied, to blame for this season’s soft ratings. He told the AGM: “We expect the poor scheduling from the AFL this year will be rectified in the coming season to help deliver even stronger audiences for our suite of live sport.”

Not that Stokes will depart with the universal thanks of shareholders who watched the share price ride up the mountain, and then down the other side. Shares that once traded at more than $14 in 2007are now worth 14 cents.

One shareholder who bought $1m worth of SWM when it was priced at$5 a share, told Stokes that his stake is now worth just $27,000. Stokes declined to take responsibility. “It’s pretty public, the challenges that we’ve faced, particularly from the platforms that come in and steal our business. If you take Netflix and YouTube and platforms, they’ve taken out last year some $6 billion in revenue that would have been normally attributed to both Seven and Nine, and Ten and News – we would have shared that revenue.

“It’s being taken offshore by people that don’t have any accountability and don’t pay tax in our country. If there’s something to be upset about, I think that’s a real reason.”

As to more bad news about the current state of the company, Stokes left to CEO Jeff Howard to deliver: the TV market has declined again. After a flat July to September quarter, this current quarter has started badly, with the total TV market down by 12-13% in October. As a result, Seven is making even more cuts. Planned savings of $35m this financial year have been accelerated to $50m.

For the first half of this financial year, Seven West Media now expects to see revenue down by 1%, with the extra cuts (and more regional revenue thanks to acquiring Southern Cross Austereo’s TV licences) helping increase profits compared to the same time last year.

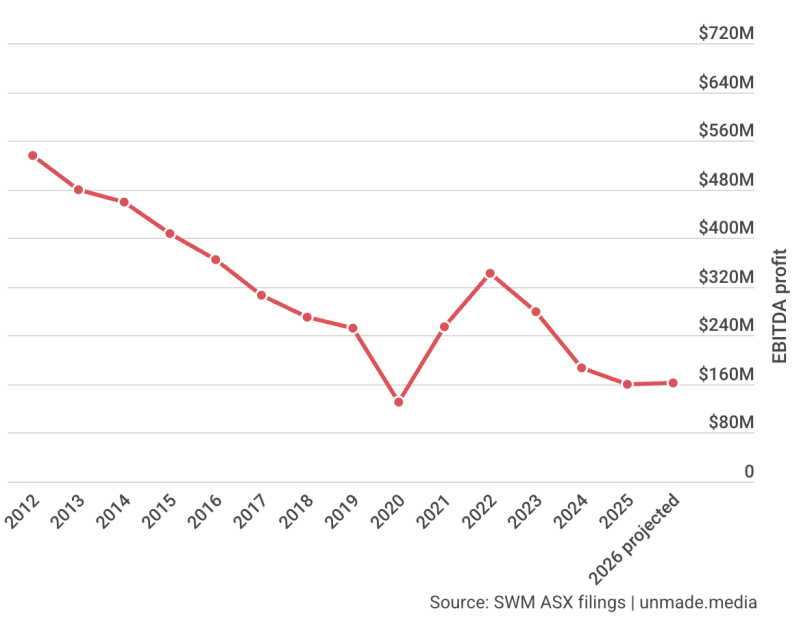

For shareholders, that’s the good news. The company’s EBITDA (earnings before interest, taxation, depreciation and amortisation) profit number for the full financial year is on target to be $161m, Howard said. That compares to profits of $280m, $187m and $159m in FY23, FY24 and FY25.

Actually, let’s be completely clear. The language actually used by Howard was “SWM continues to target FY26 EBITDA consensus of approximately $161m.”

Thanks to big cuts, SWM is still targeting mild profit growth

“Continues to target” sounds a little more like an aspiration than a promise.

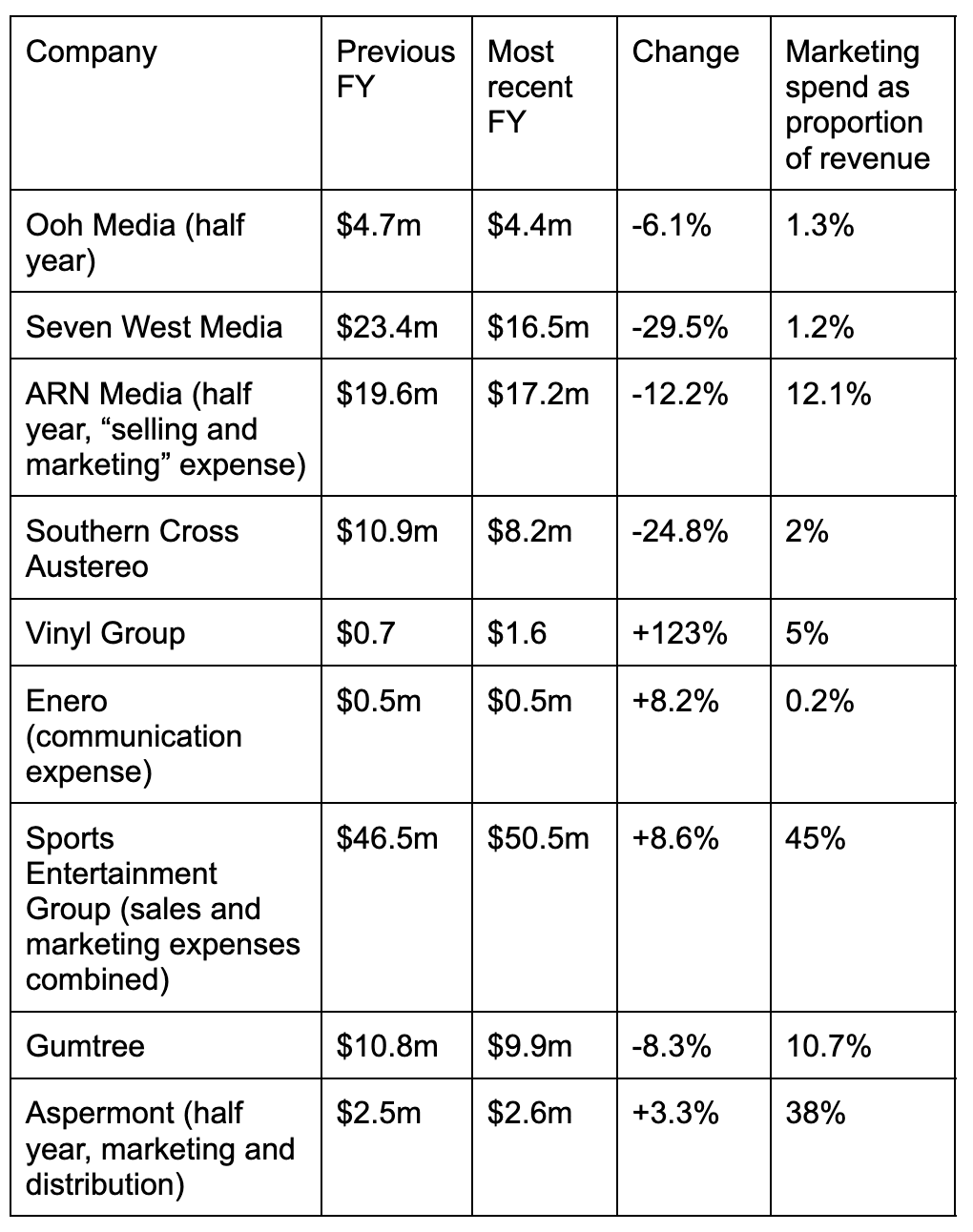

A key question for the owners of the newly merged company is how long the management will be able to go on cutting towards profit growth. One area where long term investment has already been dramatically cut is in marketing of both companies’ brands. Our analysis in September showed that SWM had cut its marketing spend by 29.5% while SCA had reduced its marketing spend by 24.8%.

How the ASX-listed media companies have been cutting their own marketing investments to drive short term profits.

With a contentious merger yet to get out of the way, the short termism is understandable, but will be a challenge for the management of the new company looking to regain momentum. The boss of that new company will also be Jeff Howard.

Future Jeff may not thank Past Jeff.