Nielsen survey shows Australian online consumer confidence dropping

New figures released by Nielsen show that Australian online consumer confidence has declined over the last 12 months, and dropped below the neutral mark for the first time since early 2009.

The announcement:

A YEAR OF DECLINE: AUSTRALIAN CONSUMER CONFIDENCE FALLS FOR FOURTH SUCCESSIVE QUARTER

• The economy re-emerges as a top concern for consumers

• Perceptions of local job prospects over the next 12 months worsen

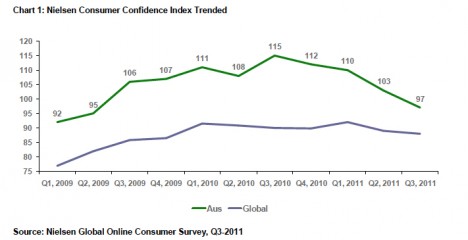

• Consumers still stashing their cashSYDNEY, Australia: November 10, 2011—According to third quarter global online consumer confidence findings from Nielsen, a leading global provider of insights and analytics into what consumers watch and buy, Australian consumer confidence slipped a further six points on the previous quarter’s (July) score of 103, to reach an of index of 97, dropping below the neutral 100 mark for the first-time since early 2009. Australia’s index, however, remains nine points above the global average index of 88 (Chart 1). With Australian consumer confidence now in steady decline for a year, Aussies are pessimistic about the health of their country’s economy.

Chris Percy, managing director, Pacific, Nielsen Consumer Group said: “The third quarter was one of volatility and stock market uncertainty as global financial markets plunged on the back of the US credit downgrade and fears over the worsening European sovereign debt crisis. Unfortunately, Australia has not been immune to what’s happening to rest the world, and the result has been a further weakening in both business and consumer confidence. “A recessionary mindset is growing among consumers, as just over a third of consumers (34%) now believe that Australia is in recession—up seven percentage points on the last quarter and 14 points from the start of year. “As we move into the final months of the year, the much-anticipated recent rate cut by the Reserve Bank—the first cut in more than two-and-half years—should bolster the economy and boost consumer spending in the run up to Christmas, which will be very welcome news for Australian retailers which, up until now, had been forecasting a soft end to what’s already been a difficult trading year.” Economic Jitters For just over a quarter (27%) of consumers, the economy re-emerged as one of the top concerns for Australians. This trend is echoed globally where one-in-four householders nominated the economy as their top concern. Utility bills also remain a top concern—more than one-in-three householders cited this as their biggest worry. The majority of consumers (57%) agree that now is not a good time to buy the things they want and need. Job prospects over the next 12 months are also softer, with just under half (45%) of consumers believing that job prospects are not good, an increase of 12 percentage points on the previous quarter. Cash is King One-in-every-two Australians is now putting any spare cash into savings, an indication that Aussies are still feeling cash-strapped as the rising cost of living continues to pinch household budgets. This is an increase of three percentage points on the last quarter, and is on par with the same period last year, but remarkably, it is the lowest savings percentage recorded in Asia Pacific. As in the previous quarter’s findings, nearly a fifth (17%) of consumers have no spare cash after covering essential living expenses, an increase of six percentage points compared to the same period last year.

Source: Nielsen press release