Prime Media posts $12.28m loss after decline in TV advertising revenue

Prime Media Group has reported a revenue and profit slump in its latest annual report as the company deals with a softer regional TV advertising market, writedowns on its broadcasting licenses and increased programming costs.

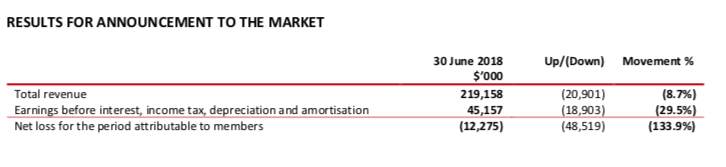

The regional Seven affiliate network reported an 8.7% fall in revenues which tipped the company into a $12.28m net loss after tax, down from a $56m profit the previous year.

EBITDA (earnings before interest, tax, depreciation and amortisation) for the group was $45.2m, down 29.5% from last year’s $64.1m, while revenues fell $238.3m from to $219.2m.

Last year the company warned it expected a profit fall of 18-25% in its annual report after the 2016 earnings boost from the Rio Olympics.

Prime’s chief executive officer, Ian Audsley, put a positive spin on the announcement, telling the market: “We’re pleased to have delivered a core net profit of $25.3m that is at the high end of market guidance. It’s a good result in an otherwise challenging year.

“Our sales teams maintained an industry-leading revenue share of 41.9% and extracted optimal opportunity from the Gold Coast Commonwealth Games in the second half, which somewhat ameliorated the choppiness of the regional TV ad market.”

Last week competitor Southern Cross Austereo claimed its regional TV revenues had grown 3.6%.

Driving Prime’s losses were an 8% fall in regional advertising revenues along with a $51.7m writedown of the network’s television licenses to “reflect the ongoing decline of the regional free-to-air television advertising markets” and increased contributions to Seven’s production costs under its program supply agreement.

In a statement to the ASX, Audsley said: “Prime made the decision to seek an early renegotiation of its program supply arrangements with the Seven Network to ensure audience and business continuity over the next five years – a step that was necessary for Prime to understand its capacity to grow into the future.”

At the time of the announcement that Prime would increase its payments to Seven, Audsley said: “Seven has made substantial up-front investments in key sports rights and uniquely Australian content to drive audience performance in an increasingly competitive environment. We recognise that these investments form the cornerstone to Prime’s leading position in regional television.

“Accordingly, we have increased our contribution to these investments and we are delighted to further extend our relationships with Seven.”

Further increasing losses, operating costs were also up 10.25% to $5.1m which saw the company make management cuts aimed to deliver $1.8m savings per year.

“With the core business secured for the medium term and debt at historic low levels, the company now has the opportunity to understand and evaluate its opportunities,” Audsley said. “Management is also well advanced in identifying ways to mitigate the increase in program costs and the subsequent impact to earnings.”

The company said its net profit after tax for the 2019 financial year is forecast to be between $12.0m and $15.0m after taking into account market declines and increased affiliation fees.

Prime was the second best performer of Australia’s media stocks last year, posting a 9.68% gain to take its market capitalisation over $100m at the end of 2017. At the close of trading yesterday, Prime’s share price was 29c giving it a market capitalisation of $106.24m

Do not buy this stock. They have employed [Edited under Mumbrella’s comment moderation policy] The below email came to me today completely unsolicited.

Dear Adrian

I hope you are doing well.

I am interested in this stock PRT, if you can see the diagram, can you tell me what you plan to do when it goes from 0.23 to 3.53? That is almost 20 time

Even if it just get to 1.12 at 5 years ago, it is still more than 4 times up right?

Better early than sorry, what do you think Adrian?

Please let me know your thoughts, call me when you can.

Jordan Blackburn