QMS reports flat profits despite steady income growth

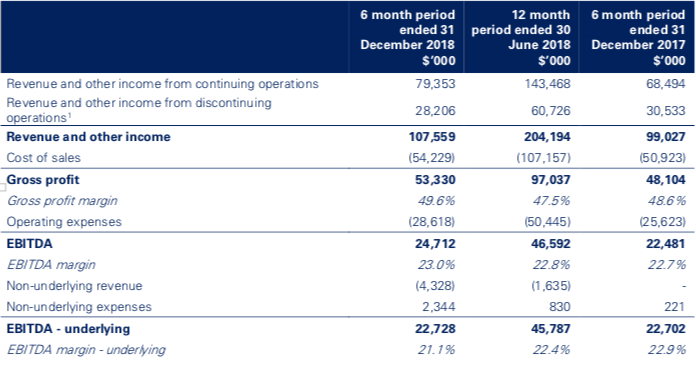

ASX listed out-of-home operator QMS has reported a 9% jump in revenue, despite flat profits, with EBITDA only moving $26,000 to $22.7m compared to the same period last year.

In its first half financial report, the company noted sales had increased to $107.6m, up from $99.1m the year before, on the back of a strong performance in the Australian out-of-home market.

The $8m revenue jump was largely absorbed by a $3.5m increase in the group’s cost of sales and a $3m increase in operating expenses.

Another factor affecting QMS’s costs were higher contract rights costs in its sports division. QMS Sports lost $300,000 on revenues of $13m.

Commenting on the results, QMS group chief executive officer Barclay Nettlefold said: “The company has delivered another solid performance, demonstrating an ability to effectively manage changing sector dynamics to drive value and growth and to leverage our competitive advantage.

“Delivering on our strategic plan across our three business segments: QMS Australia, QMS NZ and QMS Sport, which encompasses digital technology supported by a proprietary data and analytics platform, we continue to build an industry leading portfolio for growth.

“Our differentiated market proposition focuses on quality, not volume and reinforces the strength of our strategy, continuing to drive revenue synergies across the Group. Our results demonstrate another period of revenue growth and our strength in digital and technology continues to define our success.”