QMS half year revenue climbs to $99m on strong digital performance

Revenue from QMS’ expanding digital inventory has been a major contributor to the company’s half year FY18 results, with digital out of home contributing 66% of QMS’ $99m total revenue and 76% of domestic media revenue.

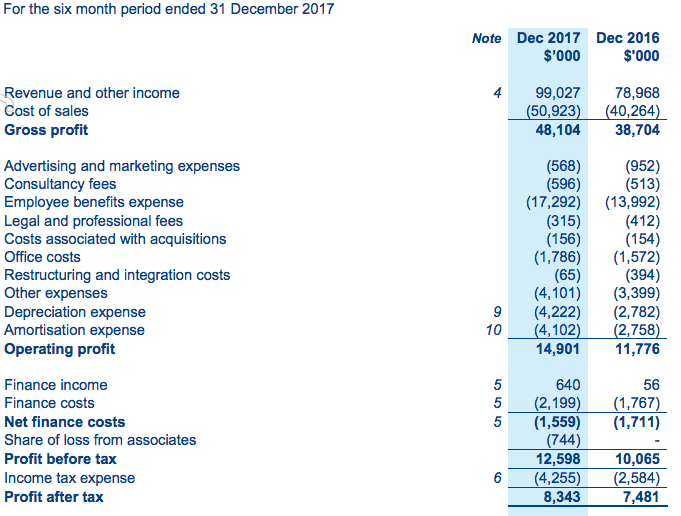

The results, posted on the ASX this morning, also showed earnings before interest, tax, depreciation and amortisation (EBITDA) climbed to $22.481m from $17.316m in the previous corresponding period.