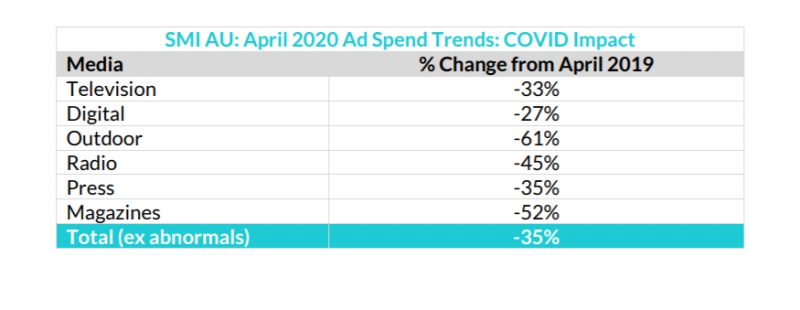

SMI data shows ad spend fell 35% in first full month of COVID-19

The first ad spend figures for a full month of the COVID-19 pandemic lockdowns have been released by the Standard Media Index (SMI), showing a drop of 35.4% in media agency advertising expenditure across the board.

The fall equates to $331.13m of spend, but forward pacing data from the measurement body shows June may be the next time the industry sees improvement.