Troubled streaming player Quickflix left with $659,000 in cash after $600,000 tax break

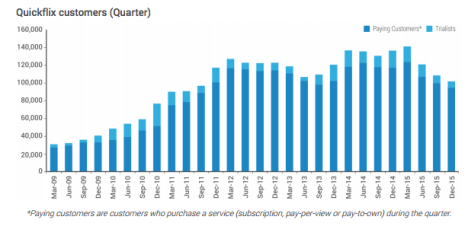

Quickflix has seen its subscriber base fall again, with its latest market update showing its paying subscribers fell by 22 per cent in he final part of 2015.

Source: ASX Update. Click to enlarge.

The troubled DVD and video streaming company had 117,106 subscribers a year ago, but had just 91,817 as of December 31.

Last quarter Quickflix, which has been in an ASX trading halt since July, lost $164,000 and now has just $659,000 in cash on hand after receiving a $600,000 research and development grant.

Kill it already. Any other business would have fallen on its sword and died by now.

I’m so happy my tax dollars are pissed away on businesses that have lost a fortune very year for over a decade, and are so ridiculously outgunned and irrelevant that it staggers belief the staff would show up everyday.

How on earth does a failing company get a government research grant

Been streaming for years now and I’m pretty sure i should have heard of quickflix. And you can’t seriously compare presto to stan and netflix.

I grew up in the country and when a farm animal was this sick dad used to get his gun and take it for a visit up the back paddock.