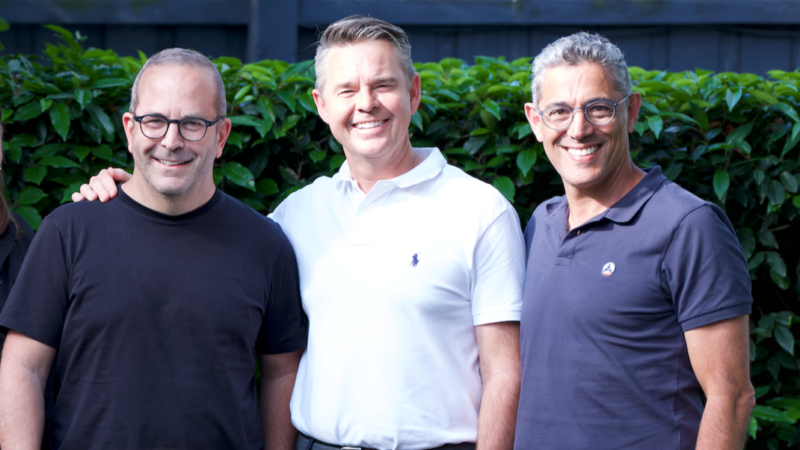

Todd Woodbridge named Inviva brand ambassador

Tennis legend Todd Woodbridge is a brand ambassador for Inviva – a home equity release lender.

The announcement:

"*" indicates required fields

Sign up to our free daily update to get the latest in media and marketing.